Claws&Horns Analytics provides this

content/feature as no more than information. In particular no advice is

intended to be provided or to be relied on as provided nor endorsed by

Claws&Horns Analytics; nor any solicitation or incentive

provided to subscribe for or sell or purchase any financial instrument

or to join and/or terminate any of the trading strategies featuring as

Trading Signal solution. The Investor is solely responsible for the

choice of the signal provider, choice of trading strategy, choice

whether to join or to terminate the relevant Trading Signals feature on

his/her trading account and monitoring of the trading activities under

Trading Signals feature. All trading or investments you make must be

pursuant to your own unprompted and informed self-directed position.

Please keep in mind that past performance is no guarantee of future

results.

The Bonus is not granted automatically.

The client must claim / request the Bonus by

contacting finance department

or via livechat.

2016-09-06 11:48 (GMT+2) Gold

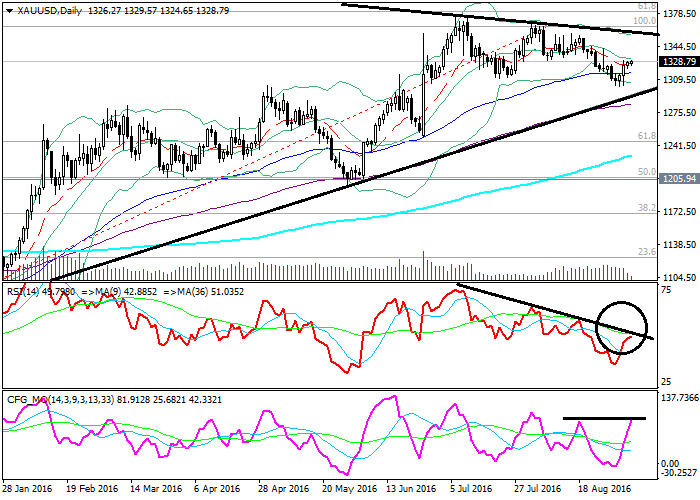

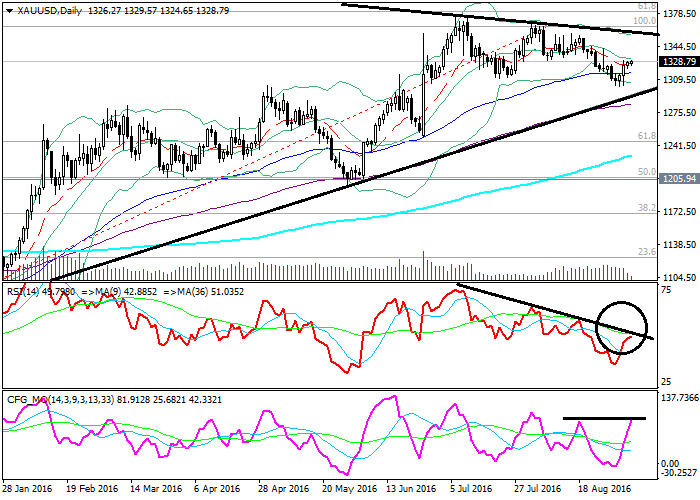

XAU/USD, D1

On the daily chart, the instrument is trading just below the middle MA of Bollinger Bands. The price remains above its moving averages that are directed up. The RSI is testing its longer MA from below. The Composite is testing its most recent resistance.

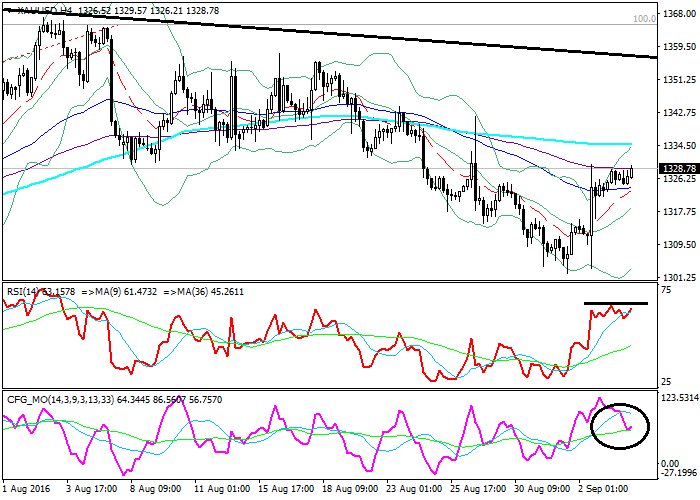

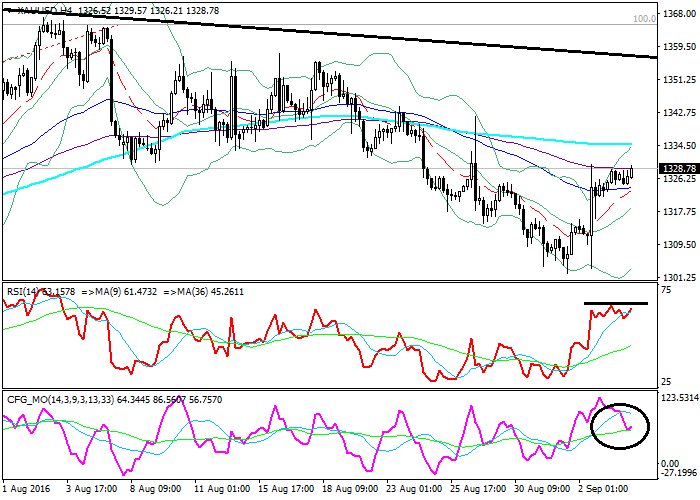

XAU/USD, H4

On the 4-hour chart, the instrument is trading in the upper Bollinger band. The price remains on the level with its moving averages that are horizontal. The RSI is testing its most recent resistance. The Composite is testing its longer MA.

Key levels

Support levels: 1310.16 (July lows), 1304.02 (local lows), 1280.09 (March highs).

Resistance levels: 1329.84 (local highs), 1345.52 (local highs), 1365.08 (August highs).

Trading tips

The price turned up just above its medium-term ascending trendline and could retest its local highs in the region of 1345.52.

Long positions can be opened from the level of 1332.84 with the target at 1344.52 and stop-loss at 1328.02. Validity – 1-2 days.

Short positions can be opened from the level of 1302.02 with the target at 1283.09 and stop-loss at 1310.16. Validity – 2-3 days.

On the daily chart, the instrument is trading just below the middle MA of Bollinger Bands. The price remains above its moving averages that are directed up. The RSI is testing its longer MA from below. The Composite is testing its most recent resistance.

XAU/USD, H4

On the 4-hour chart, the instrument is trading in the upper Bollinger band. The price remains on the level with its moving averages that are horizontal. The RSI is testing its most recent resistance. The Composite is testing its longer MA.

Key levels

Support levels: 1310.16 (July lows), 1304.02 (local lows), 1280.09 (March highs).

Resistance levels: 1329.84 (local highs), 1345.52 (local highs), 1365.08 (August highs).

Trading tips

The price turned up just above its medium-term ascending trendline and could retest its local highs in the region of 1345.52.

Long positions can be opened from the level of 1332.84 with the target at 1344.52 and stop-loss at 1328.02. Validity – 1-2 days.

Short positions can be opened from the level of 1302.02 with the target at 1283.09 and stop-loss at 1310.16. Validity – 2-3 days.

Scenario

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1332.84 |

| Take Profit | 1344.52 |

| Stop Loss | 1328.02 |

| Key Levels | 1280.09, 1304.02, 1310.16, 1329.84, 1345.52, 1365.08 |

Alternative scenario

| Recommendation | SELL STOP |

| Entry Point | 1302.02 |

| Take Profit | 1283.09 |

| Stop Loss | 1310.16 |

| Key Levels | 1280.09, 1304.02, 1310.16, 1329.84, 1345.52, 1365.08 |

with

M Samer Al Reifae

Official HiWayFX Representative in Romania

samer@hiwayfx.com

+40 734 277 757

Official HiWayFX Representative in Romania

samer@hiwayfx.com

+40 734 277 757

- YOU WILL NEVER TRADE ALONE -

YOU SHOULD NOT TAKE ANY MATERIAL posted on this BLOG AS RECOMMENDATIONS

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

Do your own due diligence.

No one knows tomorrow's price or circumstance.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.