Bitcoin price shows some bullish bias

since morning to retest the previously broken bullish trend line, which

meets the resistance of the bearish channel that appears in the above

chart, as long as the price below 1024.67 level, so the bearish trend

scenario will remain active for today, waiting for targeting 880.35 then

751.34 levels mainly.

Therefore, the bearish trend will remain active unless witnessing clear breach and stability above 1024.67 and 1089.18 levels.

Expected trading range for today is between 880.35 support and 1015.00 resistance

Expected trend for today: Bearish

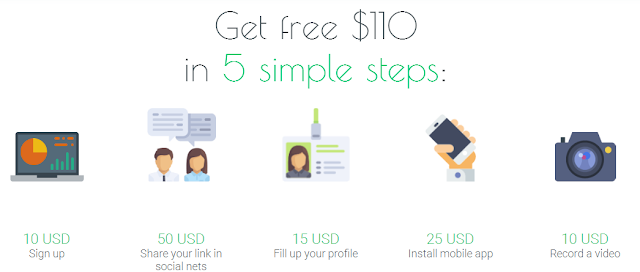

Sign up now & Complete the task.

You will get a free deposit up to $120 for start and you will get a profit of 0.05% per day without any investments.

For those who want to deposit, the profit is 1.6% per day For life.

What you watting for!

Invest in auction real estate and get daily lifelong profit.

Our Headquarters in 6 countries (USA, SWITZERLAND, GERMANY, CZECH, POLAND & FRANCE)

Invest Bitcoin in auction real estate And get daily lifelong profit.

There are about $120 you can get without any investments.

There are about $120 you can get without any investments.

April 5 in a live, the winner will be chosen via random.org!

Super prize - $ 10 000

1st place - $ 2500

2nd place - $ 1500

3rd place - $ 1200

4th place - $ 1000

5th place - $ 800

6-20 place - $ 100

20-50 place - $ 50

For More Info Click Here

with

M Samer Al Reifae

Official W3Coins Representative in East Europe & Middle East

samer@w3coins.com

+40 734 277 757

Official W3Coins Representative in East Europe & Middle East

samer@w3coins.com

+40 734 277 757

- YOU WILL NEVER TRADE ALONE -

YOU SHOULD NOT TAKE ANY MATERIAL posted on this BLOG AS RECOMMENDATIONS

TO BUY OR SELL BITCOIN, GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

TO BUY OR SELL BITCOIN, GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

Do your own due diligence.

No one knows tomorrow's price or circumstance.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.