18 April 2016, 10:03

| Scenario | |

|---|---|

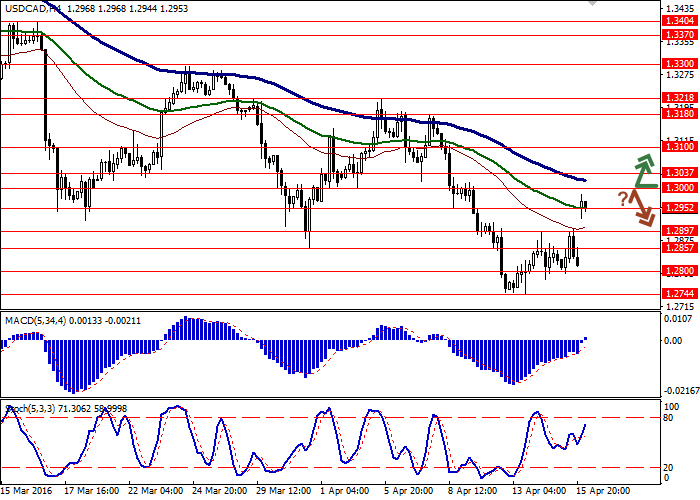

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3050 |

| Take Profit | 1.3180 |

| Stop Loss | 1.2990 |

| Key Levels | 1.2700, 1.2744, 1.2800, 1.2857, 1.2952, 1.3000, 1.3037, 1.3100, 1.3180, 1.3218 |

| Alternative Scenario | |

|---|---|

| Recommendation | SELL LIMIT |

| Entry Point | 1.3030 |

| Take Profit | 1.2850 |

| Stop Loss | 1.3050 |

| Key Levels | 1.2700, 1.2744, 1.2800, 1.2857, 1.2952, 1.3000, 1.3037, 1.3100, 1.3180, 1.3218 |

Current Trend

The USD/CAD pair gapped up to last Monday’s levels. The dynamics is explained

by the publication of the Doha meeting results. Oil producers failed to strike a

deal on freezing output.

At the end of the previous week, the US currency was under pressure from poor

macroeconomic data on industrial production and consumer confidence. The US

industrial output was down by 0.6% against a predicted decline by 0.1%. The

Consumer Sentiment Index fell from 91.0 to 89.7 points while analysts expected a

growth to 92.0 points.

Canada’s data for February on Manufacturing Shipments was also quite

disappointing. After 2.3% growth in the previous month, the indicator fell by

3.3% that was twice worse than analysts forecast.

Support and Resistance

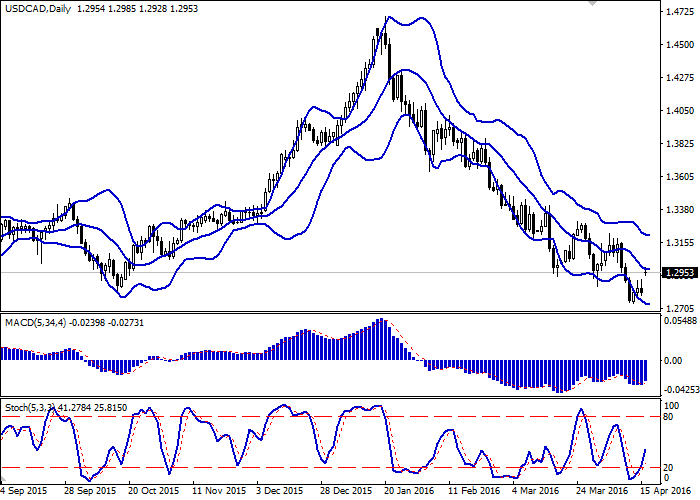

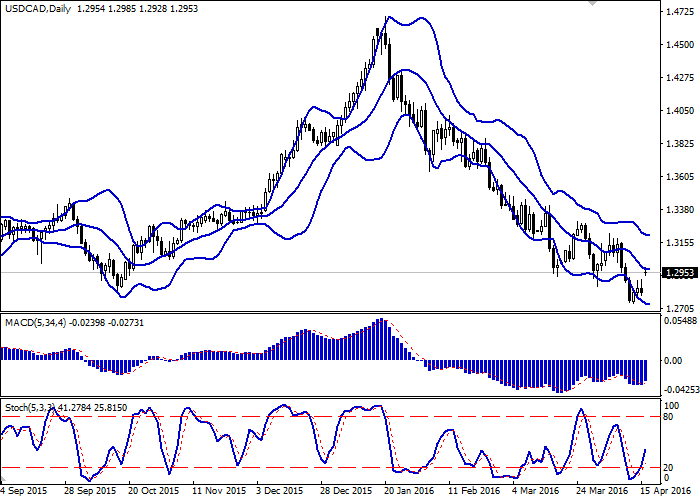

Bollinger Bands on the daily chart is trying to turn horizontally while the

price range tends to remain unchanged. MACD has turned up and formed a buy

signal. Stochastic is moving away from the border of the oversold zone.

According to the indicators, long positions seem more preferable.

Support levels: 1.2897, 1.2857, 1.2800, 1.2744 (13 April low), 1.2700.

Resistance levels: 1.2952, 1.3000 (strong psychological level), 1.3037,

1.3100, 1.3180 (7 April high), 1.3218 (5 April high).

Trading Tips

Long positions can be opened after the level of 1.3036 is broken out (with

appropriate indicators signals) with the target at 1.3180 and stop-loss at

1.2990. Validity – 1-2 days.

If the price fails to overcome the level of 1.3000, it is likely to turn

down. Pending sell orders can be placed at the level of 1.3030 with the target

at 1.2850 and stop-loss at 1.3050. Validity – 1-2 days.

The Bonus is not granted automatically.

The client must claim / request the Bonus by

contacting finance department

at finance@hiwafx.com

or via livechat.

Terms & Conditions

The client must claim / request the Bonus by

contacting finance department

at finance@hiwafx.com

or via livechat.

Terms & Conditions

with

M Samer Al Reifae

Official HiWayFX Representative in Romania

samer@hiwayfx.com

+40 734 277 757

Official HiWayFX Representative in Romania

samer@hiwayfx.com

+40 734 277 757

- YOU ARE NEVER LEFT ALONE -

YOU SHOULD NOT TAKE ANY MATERIAL posted on this BLOG AS RECOMMENDATIONS

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

Do your own due diligence.

No one knows tomorrow's price or circumstance.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.