Follow The XM Bull

Fundamentals

According to Reuters news, gold rose to a six-month high on Friday as

investors turned to bullion as a safe-haven from East-West tensions

before a vote planned for Sunday on whether Ukraine's Crimea region

should join Russia. Moscow shipped more troops and armor into Crimea on

Friday and repeated its threat to invade other parts of Ukraine, showing

no sign of heeding Western pleas to back off from a Cold War-style

confrontation. Russia's stock markets tumbled and the cost of insuring

its debt soared on the last day of trading before pro-Moscow authorities

in Crimea hold a referendum on joining Russia, a move all but certain

to lead to U.S. and European Union sanctions on Monday. "There are people here with possible concerns that you will see a heavy price spike (in gold) if this vote does go in," said Thomas Capalbo, a precious metals trader at Newedge, a brokerage in New York. "Gold is up on situational buying." The metal has gained 3 percent this week, also helped by China's first corporate bond default and fears of slowdown in the world's second-largest economy. Gold was also supported by Friday's data showing U.S. consumer sentiment weakened in early March.

FED WATCH

The market was awaiting the U.S. Federal Reserve's policy meeting on March 18-19. The central bank is expected to announce another $10 billion cut to its bond-buying stimulus. .S. economic data showing that growth has been hurt by severe cold weather has recently hit the dollar, which fell 0.2 percent against a basket of currencies after weak U.S. producer prices on Friday. Global uncertainties sent investors looking for gold, with holdings in SPDR Gold Trust - the world's largest gold-backed exchange-traded fund - rising 2.1 tonnes to 813.30 tonnes on Thursday.

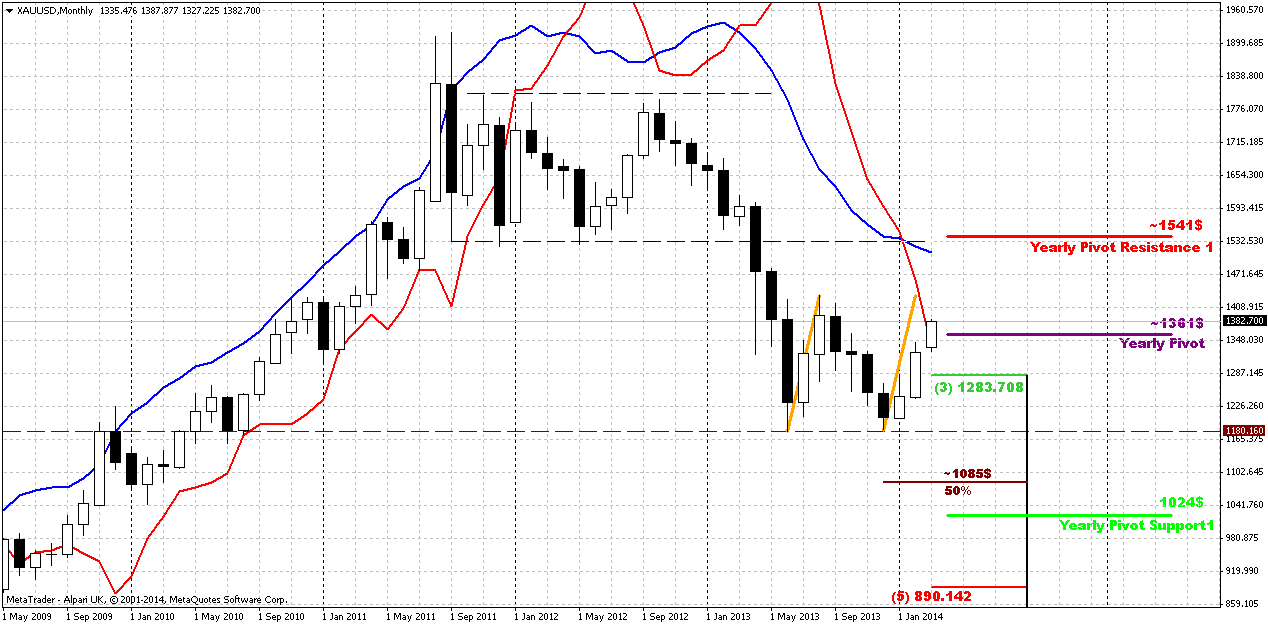

Monthly

On previous week market has created couple of moment that could have

important consequences in long-term perspective. First is – price has

moved above Yearly Pivot point and this has happened almost without any

struggle. Second moment – monthly trend could turn bullish

in March. At least right now price stands above MACD Predictor. This

situation also could shift to stop grabber, right? But anyway, despite

what it will be either bullish or bearish result – this will be very important. From fundamental part of view there two opposite opinions. Some analysts tell about 1050-1100 level and point that current action comes from negative US data, but this data is a result of heavy winter. As spring will come – data will improve and rally will be over. Others have opposite opinion. In general, here is excellent article on bloomberg, dedicated to gold, I’ll keep it here for another week:

Top Two Gold Forecasters Remain Bearish After 2014 Rally - Bloomberg

Second opinion comes from UBS – it opositely has increased forecast on gold:

Gold Losing Stigma for UBS as Tully Increases Forecasts for 2014 - Bloomberg

(But guys, to be honest, I suspect that both forecasts could be reached.

Recall our long-term expectation – two leg retracement down. Now we

expect deep retracement and later return to previous lows. Hence, first

forecast of higher prices has relation to current retracement, while

second one – to second leg, when gold due bearish momentum should return

right back down to current lows.)Second opinion comes from UBS – it opositely has increased forecast on gold:

Gold Losing Stigma for UBS as Tully Increases Forecasts for 2014 - Bloomberg

Let me add just two cents from my own to fundamental picture. Shortly speaking – I think that situation around Ukrain will become tougher in nearest months. It will not get any relief soon. If even all events will stop right now and will not change at all – this is a big host of problems that will require to dig out. But situation becomes tougher. Now South-East Ukraine fall in chain reaction on Crimea referendum. Mass strikes and separation calls sound louder and louder. This hardly will stop very soon and consequences could be really terrible. I’m afraid that we will get spike up on Monday’s morning. And current events do not let me stay on bearish view on gold market right now.

Next long term target yearly PR1 is also very significant. We know that gold likes to re-test previously broken lows and consolidations. 1540 area is monthly overbought, YPR1 and low border of broken long-term rectangle. As market was strongly oversold, very often it has tendency to reach overbought. Market is a impulse substance and reaction equals to counter reacion.

As another application of significantly oversold we’ve suggested retracement up. Thus, we’ve made an assumption of possible deeper upward retracement that could take a shape of AB=CD, and invalidation for this setup is previous lows around 1170s. Market right now is forming something like double bottom. Currently we should keep a close eye on move up.

That’s being said – nearest target here is 1430 resistance level, while taking in consideration golds’ habits, geopolitical tension and technical issues, now we treat probability of reaching 1540 level as very high.

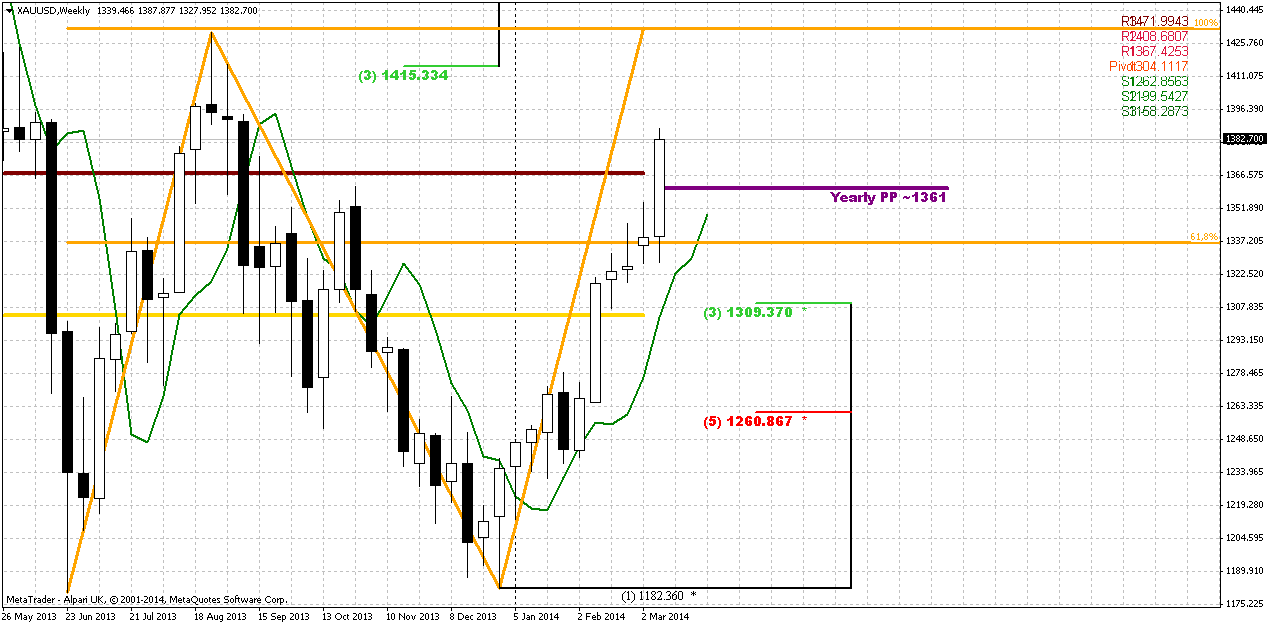

Weekly

Trend is bullish here, market is not at overbought. Currently market

shows very important information. Market has confirmed bullish ambitions

by fast and furious breakout through AB=CD minor 0.618 target and

Agreement. This area was passed by market as it was no exist. This just

tells us how strong market is. As market is not at overbought and, in

fact it has no technical barriers till 1430 level – we probably should

search possibility to take long position. From that standpoint we have

nice thrust up here that is suitable for some DiNapoli patterns. As

market has no significant barriers as we’ve said – I would probably bet

on appearing on B&B “Buy”.

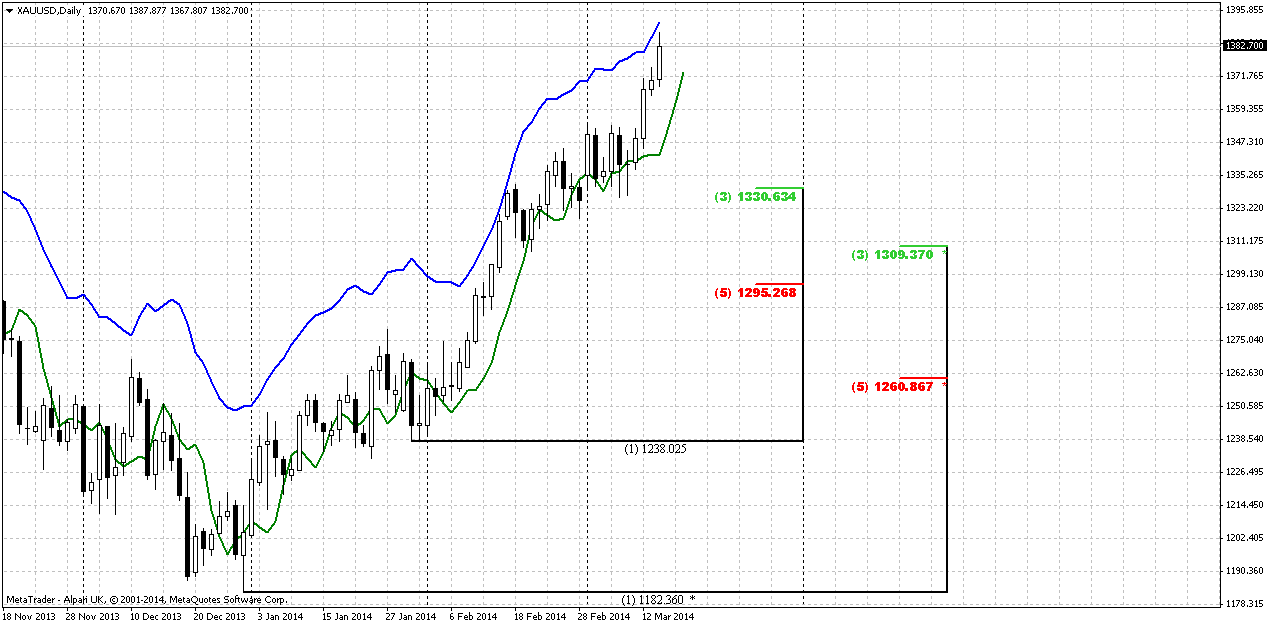

Daily

As you can see, daily chart is growing and growing and… well, you see it

by yourself. No chances for entry on long side on at least single

meaningful retracement. Now price stands at overbought. Recent thrust up

here is also suitable for DiNapoli direction pattern. May be overbought

condition will give us some chances for entry on long side of the

market. If this will happen there are two levels to watch for – 1330 Fib

support and 1295-1310 K-support area. Trend is bullish as on weekly as

on daily chart.

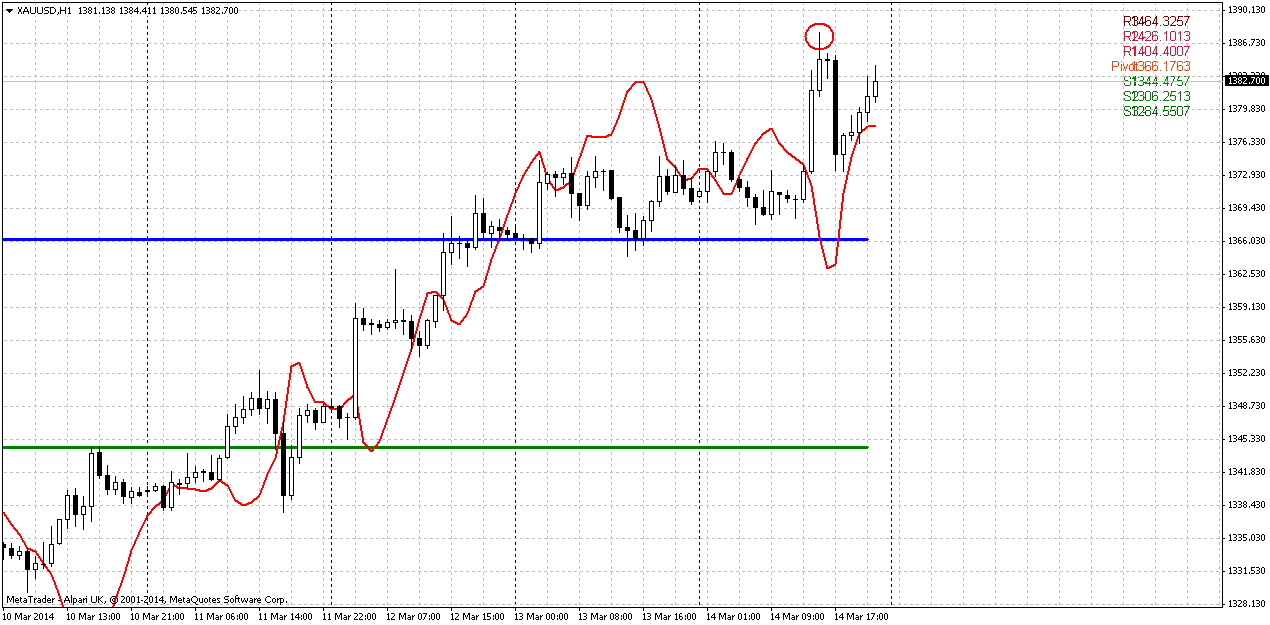

1-hour

Well, here I can tell only one thing. We have bullish grabber and it

suggests taking out of previous highs. Thus, before any retracement if

it will happen at all, of cause some upward action should happen.

Market currently stands extremely bullish .

Geopolitical tensions and fast changes in world political situation do

not let market show reaction on situation on short-term charts. When

market just starts retracement due technical issues – it breaks by some

new political or fundamental events.

Thus our major analysis mostly stands on monthly and weekly charts. On

lower time frames we can point only potential issues that could help us

to join with upward action. But no one potential pattern has been formed

yet there.

Open Real Account

Go to the XM Contest Arena

Register a Nickname and get $20 Free

All Profits Withdrawable

Free $20 Credit Added Automatically

Non Stop Contests to Join

$500,000 IN CASH PRIZES WAIT FOR YOU

What You Waiting For?

Order your XM Card

As a trader wouldn’t it be great if you could have a debit card that was globally accepted, allowing you to withdraw cash from ATMs,

make purchases in stores and online, transfer funds between your trading account and card,

and enjoy the reassurance of online customer support 24 hours a day, 7 days a week? With XM Cards you can..

Become A Master IB

The Highest Conversion in the Industry

Ability to transfer funds between IB account from/to client account

No limits on how much you can earn

No limits on how much you get paid every month

Fastest and most reliable IB payouts

Transparent reporting and detailed statistics

Account Managers in more than 18 languages

Leverage up to 1:888 for your Clients

Low Minimum Deposit for your Clients

Multiple Deposit Options for your Clients

Monthly Timely Payments

Tailor-Made Solutions

No Fees to Start

Multiple Platforms to Promote

Flexible Commission Rates

Unlimited Banners and Artwork

Nonstop Promotions for your Clients

Keep Calm & Follow The Bull

History and Background

XM is the registered trade name of Trading Point of Financial Instruments Ltd, a CySEC-regulated, FSA (UK)-registered, international forex broker with its main offices in Limassol, Cyprus. Since its establishment in 2009, the company has gained corporate reputation by virtue of their core values such as business transparency, excellent trading conditions, and professional client communication.

XM operates its financial services with full European Union authorization (including BaFin, AFM, FI, FIN, and CNMV) and by following a best execution policy for executing trading orders in real time.

XM is the next-generation broker for online forex and commodity trading, offering a wide array of progressive features for trading forex, precious metals, stock indices, and energies. What makes XM outstanding is that there are no re-quotes or rejections of trading orders, no hidden fees or commissions, and 99.35% of orders get executed in less than 1 second.

The 888:1 leverage offered by XM is unique in the industry. Over 60 currency pairs and over 100 financial instruments can be traded both online and by phone on 7 advanced trading platforms. Besides, there are no upper limits to deposits.

Beginner and seasoned traders can equally benefit from superior services and from exactly the same trading conditions, whether they open a real or a demo account. Registration is currently available in 17 languages, and trading can be started with a min. deposit of USD5 on multiple forex accounts, or on non-expiring demo accounts funded with USD100,000 virtual currency. Clients can benefit from tight spreads as low as 1 pip on the major currency pairs.

Clients can choose from three forex account types with custom-tailored conditions and base currency options for USD, EUR, GBP, JPY, CHF, AUD: MICRO account (1 micro lot = 1,000 units of the base currency), STANDARD account (1 standard lot is 100,000 units of the base currency), and EXECUTIVE account (1 standard lot is 100,000 unites of the base currency).

With generally tight spreads on over 60 currency pairs and the same spreads offered for all trading account types, XM also provides fractional pip pricing so that clients can trade with tighter spreads and benefit from the most accurate quoting possible.

XM operates its financial services with full European Union authorization (including BaFin, AFM, FI, FIN, and CNMV) and by following a best execution policy for executing trading orders in real time.

XM is the next-generation broker for online forex and commodity trading, offering a wide array of progressive features for trading forex, precious metals, stock indices, and energies. What makes XM outstanding is that there are no re-quotes or rejections of trading orders, no hidden fees or commissions, and 99.35% of orders get executed in less than 1 second.

The 888:1 leverage offered by XM is unique in the industry. Over 60 currency pairs and over 100 financial instruments can be traded both online and by phone on 7 advanced trading platforms. Besides, there are no upper limits to deposits.

Beginner and seasoned traders can equally benefit from superior services and from exactly the same trading conditions, whether they open a real or a demo account. Registration is currently available in 17 languages, and trading can be started with a min. deposit of USD5 on multiple forex accounts, or on non-expiring demo accounts funded with USD100,000 virtual currency. Clients can benefit from tight spreads as low as 1 pip on the major currency pairs.

Clients can choose from three forex account types with custom-tailored conditions and base currency options for USD, EUR, GBP, JPY, CHF, AUD: MICRO account (1 micro lot = 1,000 units of the base currency), STANDARD account (1 standard lot is 100,000 units of the base currency), and EXECUTIVE account (1 standard lot is 100,000 unites of the base currency).

With generally tight spreads on over 60 currency pairs and the same spreads offered for all trading account types, XM also provides fractional pip pricing so that clients can trade with tighter spreads and benefit from the most accurate quoting possible.

Spreads and Leverage

The 888:1 leverage offered by XM is unique in the industry. Over 60 currency pairs and over 100 financial instruments can be traded both online and by phone on 8 advanced trading platforms. Besides, there are no upper limits to deposits.

Platform

Both demo and real account XM clients can trade on as many as 8 trading platforms that support market, limit, stop and trailing orders, and directly accessible from 1 account. This speeds up trading operations and gives traders great flexibility to trade from anywhere and at anytime with ease. At XM the multi-award winning platform Metatrader 4 works with an unlimited number of demo and real accounts, and Expert Advisors (EAs) are also supported.

The available trading software is as follows: MT4 Terminal; MT4 for Mac; Web Trader; iPhone Trader; iPad Trader; Droid Trader; Mobile Trader. Apart from this, the XM MAM Trader allows multi-account management to fund/asset managers and multiple account holders with an unlimited use of charts and EAs.

The available trading software is as follows: MT4 Terminal; MT4 for Mac; Web Trader; iPhone Trader; iPad Trader; Droid Trader; Mobile Trader. Apart from this, the XM MAM Trader allows multi-account management to fund/asset managers and multiple account holders with an unlimited use of charts and EAs.

Deposits and Withdrawals

Negative balance protection, the no re-requotes and no hidden fees or commissions policy, together with the strict and real-time market execution policy rank XM among the most sought-after forex brokers.

The safety of client funds is guaranteed by funds being kept in Tier1 segregated Barclays accounts. Account funding is 100% automatic and processed 24/7, while same day withdrawals are guaranteed. Clients can choose from various modern payment options, with a wide geographical coverage: credit cards (VISA, VISA Electron, MasterCard, Switch, Solo) bank wire, Neteller, Moneybookers Skrill, Western Union, MoneyGram, WebMoney, China UnionPay, SOFORT, iDEAL. The recently introduced local bank transfer option enables investors to fund their accounts through their own local banks (in 58 countries worldwide) and in their local currencies. There are no hidden fees or commissions for funds transfers, and all transfer fees are covered by XM.

The safety of client funds is guaranteed by funds being kept in Tier1 segregated Barclays accounts. Account funding is 100% automatic and processed 24/7, while same day withdrawals are guaranteed. Clients can choose from various modern payment options, with a wide geographical coverage: credit cards (VISA, VISA Electron, MasterCard, Switch, Solo) bank wire, Neteller, Moneybookers Skrill, Western Union, MoneyGram, WebMoney, China UnionPay, SOFORT, iDEAL. The recently introduced local bank transfer option enables investors to fund their accounts through their own local banks (in 58 countries worldwide) and in their local currencies. There are no hidden fees or commissions for funds transfers, and all transfer fees are covered by XM.

Beginners' and Customer Support

Multilingual Personal Account Managers are at both demo and real account clients’ disposal via live chat, by telephone or email in over 14 languages, assisting them with professional support 24 hours on 5 business days.

Rich forex educational material is at clients’ disposal, with free weekly interactive webinars, as well as with free, uniquely developed MT 4 video tutorials. The multilingual economic calendar, along with forex news and market analysis provided by XM financial experts help clients follow market changes and adapt their trading decisions accordingly.

Conclusion

XM (TradingPoint) is committed to satisfying your every need with integrity, transparency, and the determination to serve you well. The benefits of choosing XM are clearly stated on the Home page of XM website:

• Licensed in the EU

• Tight Spreads from 1 Pip

• Flexible Leverage up to 888:1

• No Commissions

• 30% Deposit Bonus up to $10,000

• 24 Hour Support

• No Re-quotes

• Fast and Easy Withdrawals

• Personal Account Managers

• Automated Trading

• Phone Trading

• Tight Spreads from 1 Pip

• Flexible Leverage up to 888:1

• No Commissions

• 30% Deposit Bonus up to $10,000

• 24 Hour Support

• No Re-quotes

• Fast and Easy Withdrawals

• Personal Account Managers

• Automated Trading

• Phone Trading

The Gold Price & Trend Predictions blog made for gold traders to find good news and to provide the traders with daily price predictions and to learn how to trade the Forex Market for free.Just pure learning! It will be of great fun.You can judge by yourself the quality of information that I will be giving you in my blog.

Welcome to my blog where you can learn how to trade the Forex Market for free.The material is all created by myself and not copied from anywhere. There is a lot yet to come since there is a lot that you need to learn, and there is a lot that I need to share with you! So please just be patient – it will be worth it.You can judge by yourself the quality of information that I will be giving you . So just go now and start learning!

Below is a quick guide of how this website is structured, so you can find what you are looking for fast. Remember that I update the pages every day so either check back often.

In this section you will find quite a long article of what Forex is all about. If you are a beginner, this is a must read. It explains in detail what is required to start trading, what you should do and not, typical traps to avoid as a beginner and a lot of valuable information which you as a beginner must digest and learn prior opening any Forex account with real money.

In this section you will find your road map on how to become a real successful trader couple of months as from today.

In this section you will know the 3 major areas – Technical Analysis, Fundamental Analysis and Trading Physcology.

In this section you will find a gold mine of information about the technicalities of Forex. We will start from the very basics covering all the Forex jargon words which you will be hearing every day and we will be taking you up to the level required to finally learn to trade like a pro – technical analysis, also found in this section.

In this section you will see the tips that will help you stay away from crap forex products, which unfortunately the Forex market is invaded with.

This section has a very detailed article on how to avoid being scammed in this ruthless world of Forex. I will explain in detail six tips that you need to look for prior purchasing any products. Even though most of the time you may claim your money back,the time wasted is never returned. You should have used that time to learn how to trade! Read it!

YOU SHOULD NOT TAKE ANY MATERIAL posted on this BLOG AS RECOMMENDATIONS

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

Do your own due diligence.

No one knows tomorrow's price or circumstance.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.

King Regards