As Reuters reports, Gold rose on Friday, rebounding from the previous

session's drop to a one-month low, as heightened tensions between Russia

and the West over Ukraine prompted speculators to buy back their bearish

bets ahead of the weekend. For the week, however, bullion posted a near

1-percent drop, its second consecutive weekly decline, as encouraging

recent U.S. economic indicators lessened the metal's safe-haven appeal.

Gold prices climbed as Russia said the United States was trying to influence international opinion through unfounded insinuations and anti-Russian rhetoric over the crisis in Ukraine, while the Pentagon said the transfer of rocket systems from Russia to Ukrainian separatists appeared to be imminent.

"With the news flow coming out Russia and Ukraine and you don't know what's going to happen in Iraq, traders are buying gold as they don't want to get too exposed to geopolitical risks going into the weekend," said Robert Haworth, senior investment strategist at U.S. Bank Wealth Management's Private Client Reserve.

Weaker U.S. equities dragged by bellwether online retailer Amazon also lifted gold prices. The market awaited the release of July U.S. non-farm payrolls and the Federal Open Market Committee meeting, both scheduled for next week. Gold was down 0.7 percent this week, extending the previous week's 2 percent fall, mostly on speculation that an improving employment sector in the United States could signal an early rate increase by the Federal Reserve.

As a gauge of investor sentiment, holdings of the SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, fell 3.6 tonnes on Thursday - the biggest one-day drop in more than a month.

Gold prices climbed as Russia said the United States was trying to influence international opinion through unfounded insinuations and anti-Russian rhetoric over the crisis in Ukraine, while the Pentagon said the transfer of rocket systems from Russia to Ukrainian separatists appeared to be imminent.

"With the news flow coming out Russia and Ukraine and you don't know what's going to happen in Iraq, traders are buying gold as they don't want to get too exposed to geopolitical risks going into the weekend," said Robert Haworth, senior investment strategist at U.S. Bank Wealth Management's Private Client Reserve.

Weaker U.S. equities dragged by bellwether online retailer Amazon also lifted gold prices. The market awaited the release of July U.S. non-farm payrolls and the Federal Open Market Committee meeting, both scheduled for next week. Gold was down 0.7 percent this week, extending the previous week's 2 percent fall, mostly on speculation that an improving employment sector in the United States could signal an early rate increase by the Federal Reserve.

As a gauge of investor sentiment, holdings of the SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, fell 3.6 tonnes on Thursday - the biggest one-day drop in more than a month.

Well recent CFTC data shows nothing really new and significant. As OI as Net position stand flat at the FOMC meeting eve.

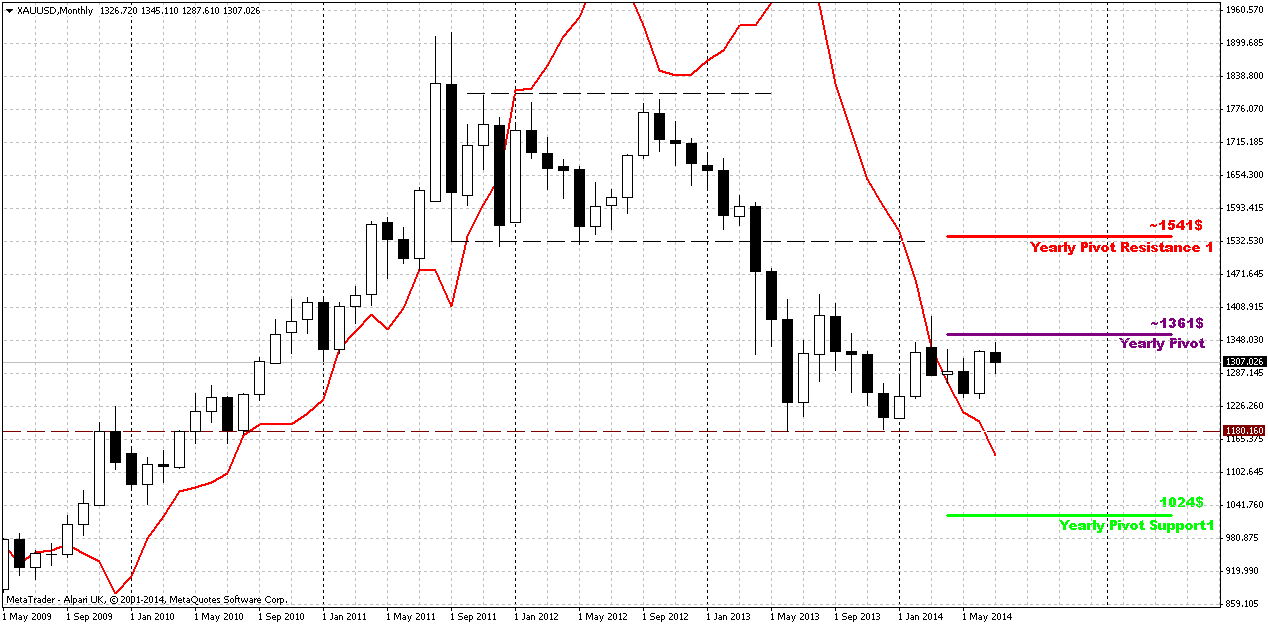

Monthly

Recent market mostly shows flat action, long term picture changes

slowly. Despite solid upward action our bearish grabber is still valid

and price should pass solid distance to change situation drastically.

Situation could change only if market will move above 1400 area.

Right now gold stands under pressure of perpsectives of USD strength – good economy data first, that right now is confirmed by US companies earning reports, expectations on Fed more hawkish assessement of perspectives and finally, week physical demand – all these moments prevent gold appreciation. The only factor that could support gold somehow is gepolitical tensions. Previously we have turmoil in Iraq and Ukraine, now Israel and Palestine added.

Grabber pattern is important, but June, and especially July has blocked gradual downward action and white candles break the bearish harmony of recent action. Next upside important level is 1360 – Yearly pivot point. If market will move above it (not neccesary it will happen in July) – this could be an indication that gold will continue move higher and this really could become a breaking moment on gold market. Otherwise, grabber will be valid and potentially could lead price back at least to 1180 lows again.

That’s being said, situation on the monthly chart does not suggest yet taking long-term positions on gold, since everything could change on coming week. Still, fundamental picture is moderately bearish in long-term. Possible sanctions from EU and US could hurt their own economies (especially EU). Many analysts already have started to talk about it. It means that economies will start to loose upside pace and inflation will remain anemic. In such situations investors mostly invest in interest-bear assets, such as bonds. Inflation also will be depressed and this is negative sign for gold.

Right now gold stands under pressure of perpsectives of USD strength – good economy data first, that right now is confirmed by US companies earning reports, expectations on Fed more hawkish assessement of perspectives and finally, week physical demand – all these moments prevent gold appreciation. The only factor that could support gold somehow is gepolitical tensions. Previously we have turmoil in Iraq and Ukraine, now Israel and Palestine added.

Grabber pattern is important, but June, and especially July has blocked gradual downward action and white candles break the bearish harmony of recent action. Next upside important level is 1360 – Yearly pivot point. If market will move above it (not neccesary it will happen in July) – this could be an indication that gold will continue move higher and this really could become a breaking moment on gold market. Otherwise, grabber will be valid and potentially could lead price back at least to 1180 lows again.

That’s being said, situation on the monthly chart does not suggest yet taking long-term positions on gold, since everything could change on coming week. Still, fundamental picture is moderately bearish in long-term. Possible sanctions from EU and US could hurt their own economies (especially EU). Many analysts already have started to talk about it. It means that economies will start to loose upside pace and inflation will remain anemic. In such situations investors mostly invest in interest-bear assets, such as bonds. Inflation also will be depressed and this is negative sign for gold.

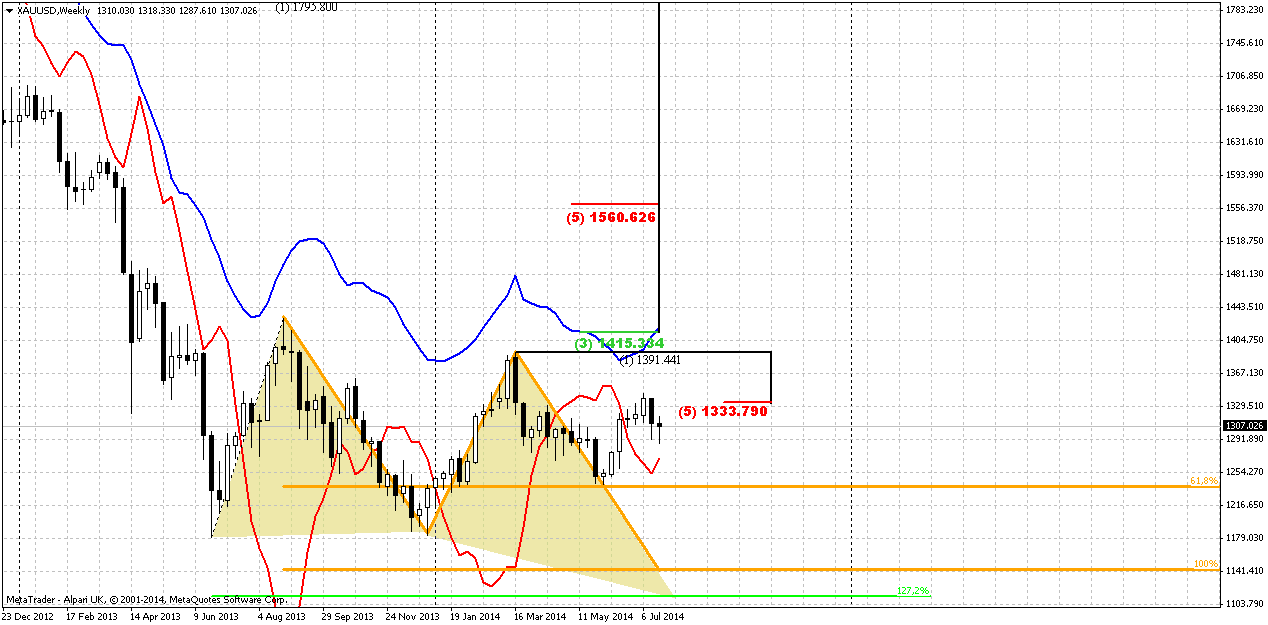

Weekly

Due to solid events that we expect at the end of coming week, long-term

picture does not change. As we’ve said previously - in nearest couple of

week the major question will be whether gold will hold above 1335 or

not. And now we stand at hot point. Usually reaching of minor target

does not suggest deep retracement. If market is really bearish it should

continue move down soon and 1335 level – 5/8 Fib resistance will become

the last edge. Retracement above 5/8 level will be too deep for minor

bounce after reaching just minor AB=CD target. Spot traders tell that as

soon as market reaches this area – buying volume starts to decline

significantly and this is also confirmed by recent CFTC data. Although

on previous week market has shown not bad bounce down, but it still

stands relatively close to 1335-1340 area and everything still could

change. It is difficult to comment just small new candle on weekly chart. We know that 5/8 resistance at 1335 is crucial for us and market already has confirmed it by downside action. Thus, we probably could say that the recent top is invalidation point for bearish setup in short-term perspective. Market should re-start move down or bearish trend or AB=CD pattern will be broken. In this case market theoretically could form butterfly “Sell” pattern.

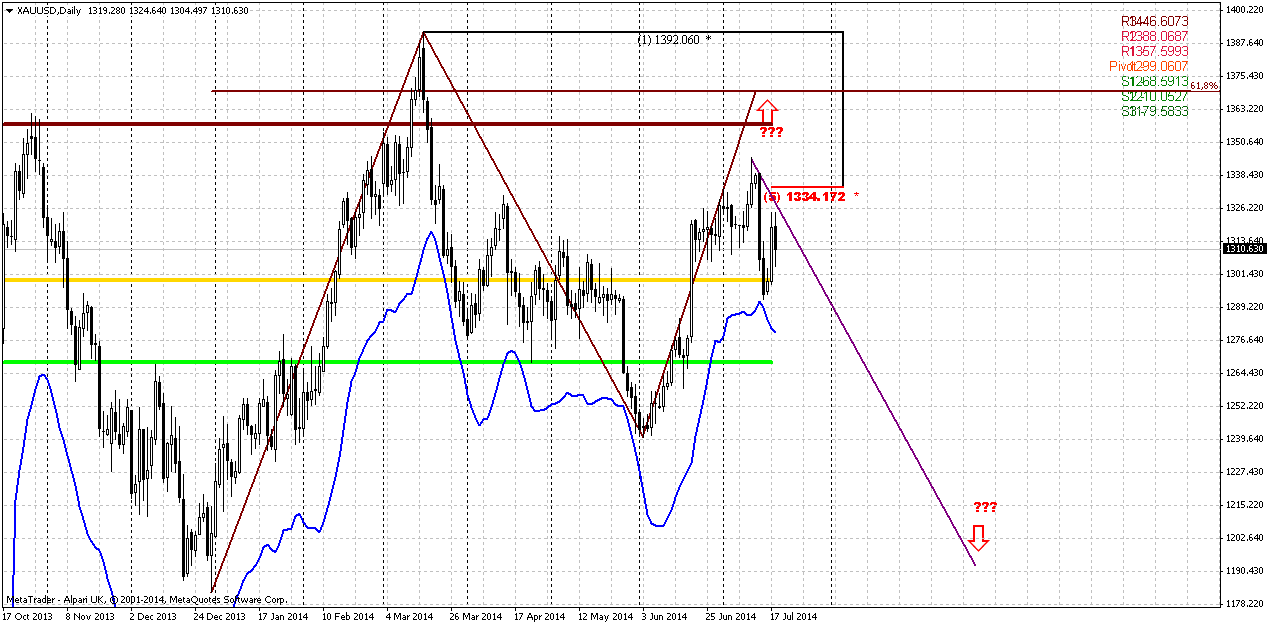

Daily

As you remember, week ago we have some concerns on possible upward

continuation, but market one by one has erased all short-term

opportunities for upside action and all potentials for bullish pattern.

We already said that upward continuation has some weak moments. First

is market failure at 1335 and inability to hold above it. This

simultaneously points as on corrective nature of upward action as

problems with further upward continuation, since plunge was really

strong. Lack of physical demand on spot market… It is difficult to count

on significant appreciation that demands breakout through strong levels

without real big inflows. Closing of shorts can’t support rally for

considerable period of time, especially it can’t push prices to new

upward achievements. Although on Friday we saw attempt to break the

situation and market even has formed bullish engulfing pattern right at

MPP and 50% Fib support level. At the same time CFTC report does not

show significant changes and looks like we should agree with others who

explained this rally by escalation on geopolitical situation.Thus nothing drastical has happened yet, but tactically now we have to get downward breakout and erasing of engulfing pattern before taking any short position. And of cause we mostly be focus on 1270 area first – MPS1 and oversold, since downside AB=CD target that we draw here stands too far yet.

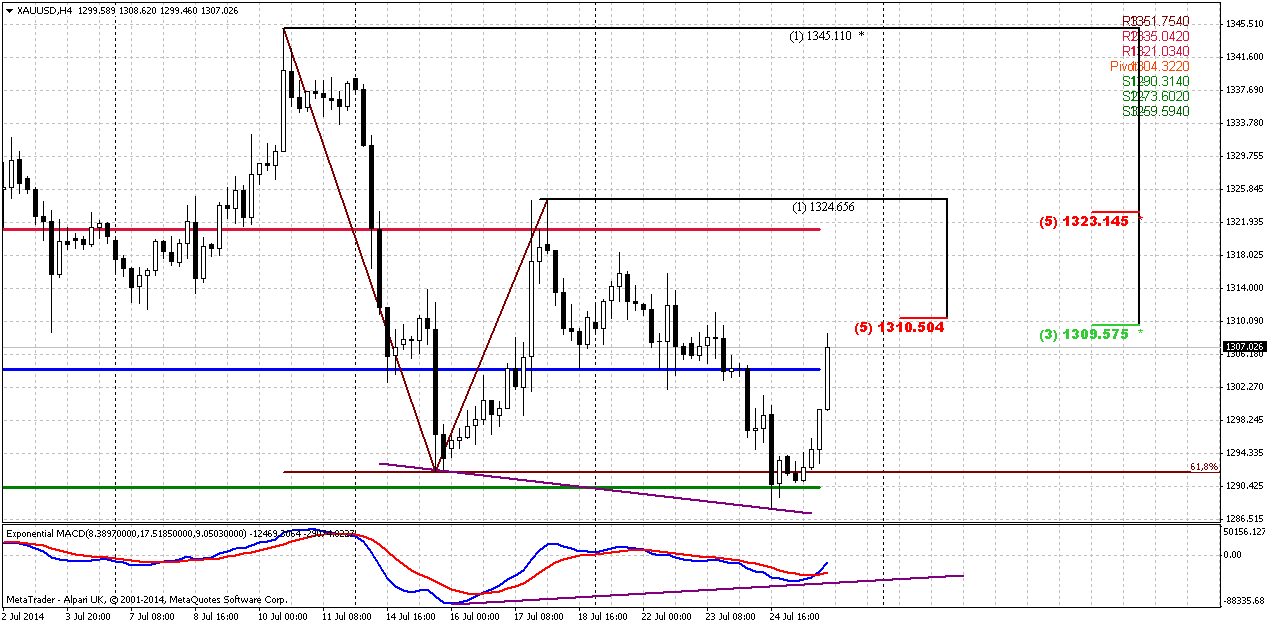

4-hour

Intraday charts shows short-term bullish setup. Despite what reason has

triggered it, technically this is bounce up from daily 50% support and

Agreement, since market also has reached minor 0.618 AB=CD target. Now

is the question how long and far this bounce will be. On Friday price

has reached K-resistance area, trend has turned bullish and we also have

bullish MACD divergence. Ultimate retracement that will keep bearish

setup intact stands at WPR1 and 1323 area Fib resistance, but it is

prefferable that market stops somewhere around WPP. Currently I do not

have any illusions on perspective of this upside motion due reasons that

we’ve discussed in fundamental part of this research. Usually when

geopolitical event triggers short-term reaction – it is unstable and

short-term. Thus, in the beginning of the week let’s be focused on WPP

and 1287 lows. In fact, to get confirmation of bearish stretngh we need

to see daily engulfing pattern vanishing. First – keep watching on WPP

and K-area. If market will turn down, this could be first sign of

downward continuation and then we will start to monitor 1287 area. But

if market will move higher – then next destination will be 1323-1325

level.

Conclusion

Market has to breakout 1400 to change long-term situation significantly.

Fundamentally situation is supportive to USD. Recent just up on Friday

mostly was due escalation of geopolitical situation and closing of some

positions on gold. Hardly this situation lasts for long period.

Investors will prepare to FOMC meeting and NFP report on coming week.

Although currently retracement up does not look like menace for bears – it still could reach 1325 area without breaking bearish sentiment. On next week we will be watch for WPP and 1310 area first and then, depending on what direction will prevail – either 1325 area or 1287 lows and vanishing of short-term daily bullish pattern.

Although currently retracement up does not look like menace for bears – it still could reach 1325 area without breaking bearish sentiment. On next week we will be watch for WPP and 1310 area first and then, depending on what direction will prevail – either 1325 area or 1287 lows and vanishing of short-term daily bullish pattern.

Samer Al Reifae

support5002@vantagefx.com

http://www.vantagefx.com/products/spreads

https://www.facebook.com/LORDOFTRUTH

https://www.facebook.com/FollowTheRaw

https://www.facebook.com/groups/vantagefx/

http://lordoftruth.blogspot.com/

See Why VantageFx ?

_Trade with Winners:

Australian financial service providers, Vantage FX,

have received a multitude of awards over the years including those from IB Times,

Deal Makers, The World Finance Foreign Exchange Awards, Smart Investor and many more.

_Vantage FX have:

Award-winning Execution Speeds

Competitive spreads from 0.0 pips

24/5 Premium Customer Support

_Trade with Choice:

Take your pick. Choose from -->

32 Forex currency pairs

Major indices including SPI200, S&P500, DJ30

Commodities – gold, silver and crude oil

Binary Options – click here to read more about this exciting, new way to trade

_Trade with flexibility:

Choose your leverage amount ranging from 1:1 to 500:1

Choose your lot size - micro, mini or standard lots

Choose your account type – Standard or Pro, Individual or Joint

_Trade Your Way:

Choose the trading solution that matches your trading style:

The popular MetaTrader 4 (MT4)

MT4 for Mac – Exclusive to Vantage FX in Australia

MetaTrader 5

WebTrader

Mobile trading apps for iPhone, iPad and Android

Social trading via FX Copy

_Trade Securely and with Transparency:

No Dealing Desk Execution. No Requotes

100% Straight Through Processing

ASIC Regulated Standards

Funds Secure in Segregated Client Accounts at NAB

_Trade Wisely:

Daily market analysis from our key expert writer and currency strategist, Greg McKenna

Daily Forex Currency Highlights reports

Learn, follow and copy leading successful traders on FX Copy

Free Autochartist tools for live Vantage FX account holders

Free webinars and access to webinar archives

Other educational resources including infographics, glossary and guides

Samer Al Reifae

support5002@vantagefx.com

https://www.facebook.com/LORDOFTRUTH

https://www.facebook.com/FollowTheRaw

https://www.facebook.com/groups/vantagefx/

http://lordoftruth.blogspot.com/

_Trade with Winners:

Australian financial service providers, Vantage FX,

have received a multitude of awards over the years including those from IB Times,

Deal Makers, The World Finance Foreign Exchange Awards, Smart Investor and many more.

_Vantage FX have:

Award-winning Execution Speeds

Competitive spreads from 0.0 pips

24/5 Premium Customer Support

_Trade with Choice:

Take your pick. Choose from -->

32 Forex currency pairs

Major indices including SPI200, S&P500, DJ30

Commodities – gold, silver and crude oil

Binary Options – click here to read more about this exciting, new way to trade

_Trade with flexibility:

Choose your leverage amount ranging from 1:1 to 500:1

Choose your lot size - micro, mini or standard lots

Choose your account type – Standard or Pro, Individual or Joint

_Trade Your Way:

Choose the trading solution that matches your trading style:

The popular MetaTrader 4 (MT4)

MT4 for Mac – Exclusive to Vantage FX in Australia

MetaTrader 5

WebTrader

Mobile trading apps for iPhone, iPad and Android

Social trading via FX Copy

_Trade Securely and with Transparency:

No Dealing Desk Execution. No Requotes

100% Straight Through Processing

ASIC Regulated Standards

Funds Secure in Segregated Client Accounts at NAB

_Trade Wisely:

Daily market analysis from our key expert writer and currency strategist, Greg McKenna

Daily Forex Currency Highlights reports

Learn, follow and copy leading successful traders on FX Copy

Free Autochartist tools for live Vantage FX account holders

Free webinars and access to webinar archives

Other educational resources including infographics, glossary and guides

Samer Al Reifae

support5002@vantagefx.com

https://www.facebook.com/LORDOFTRUTH

https://www.facebook.com/FollowTheRaw

https://www.facebook.com/groups/vantagefx/

http://lordoftruth.blogspot.com/

Get the newly designed trading tools package that can enhance your

trading and assist you in achieving your trading goals. Maximize returns

and discover new trading opportunities with this wide range of

seriously advanced tools.

What is the SmartTrader Tools Package?

Nine unique and powerful trading tools completely designed for MetaTrader 4 (MT4) and available in one user-friendly, easy-to-install package. The package includes:

Sentiment Trader

At a quick glance, see what the general sentiment is and trade directly within the same window

Correlation Trader

Determine correlation patterns between pairs in one app with key figures & notes

Session Map

A visual world sessions map synced to your local time-zone with calendar events

Trade Terminal

Advanced trade execution and analysis tool for quick, precision trading

Excel RTD Link

The bridging tool for Excel pros allowing you trade from Excel based trading rules

Alarm Manager

Go beyond just receiving alerts. Automatically trigger orders or close trades based on your pre-set rules.

Correlation Matrix

A flexible and comprehensive matrix grid. See at a glance correlation scores and the strength of patterns.

Market Manager

Customise and create a Market Watch window with different layout options

Connect Panel

Your personal pick of news feeds and Binary Options trading direct from MT4

How do you get the package free?

Visit our SmartTrader Tools webpage for more information on each tool and how to register.

Why Vantage FX?

Trade with Winners

Australian financial service providers, Vantage FX, have received a multitude of awards over the years including those from IB Times, Deal Makers, The World Finance Foreign Exchange Awards, Smart Investor and many more.

Vantage FX have

Award-winning Execution Speeds

Competitive spreads from 0.0 pips

24/5 Premium Customer Support

The Gold Price & Trend Predictions blog made for gold traders to find good news and to provide the traders with daily price predictions and to learn how to trade the Forex Market for free.Just pure learning! It will be of great fun.You can judge by yourself the quality of information that I will be giving you in my blog.

Welcome to my blog where you can learn how to trade the Forex Market for free.The material is all created by myself and not copied from anywhere. There is a lot yet to come since there is a lot that you need to learn, and there is a lot that I need to share with you! So please just be patient – it will be worth it.You can judge by yourself the quality of information that I will be giving you . So just go now and start learning!

Below is a quick guide of how this website is structured, so you can find what you are looking for fast. Remember that I update the pages every day so either check back often.

In this section you will find quite a long article of what Forex is all about. If you are a beginner, this is a must read. It explains in detail what is required to start trading, what you should do and not, typical traps to avoid as a beginner and a lot of valuable information which you as a beginner must digest and learn prior opening any Forex account with real money.

In this section you will find your road map on how to become a real successful trader couple of months as from today.

In this section you will know the 3 major areas – Technical Analysis, Fundamental Analysis and Trading Physcology.

In this section you will find a gold mine of information about the technicalities of Forex. We will start from the very basics covering all the Forex jargon words which you will be hearing every day and we will be taking you up to the level required to finally learn to trade like a pro – technical analysis, also found in this section.

In this section you will see the tips that will help you stay away from crap forex products, which unfortunately the Forex market is invaded with.

This section has a very detailed article on how to avoid being scammed in this ruthless world of Forex. I will explain in detail six tips that you need to look for prior purchasing any products. Even though most of the time you may claim your money back,the time wasted is never returned. You should have used that time to learn how to trade! Read it!

YOU SHOULD NOT TAKE ANY MATERIAL posted on this BLOG AS RECOMMENDATIONS

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

Do your own due diligence.

No one knows tomorrow's price or circumstance.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.

King Regards