Fundamentals

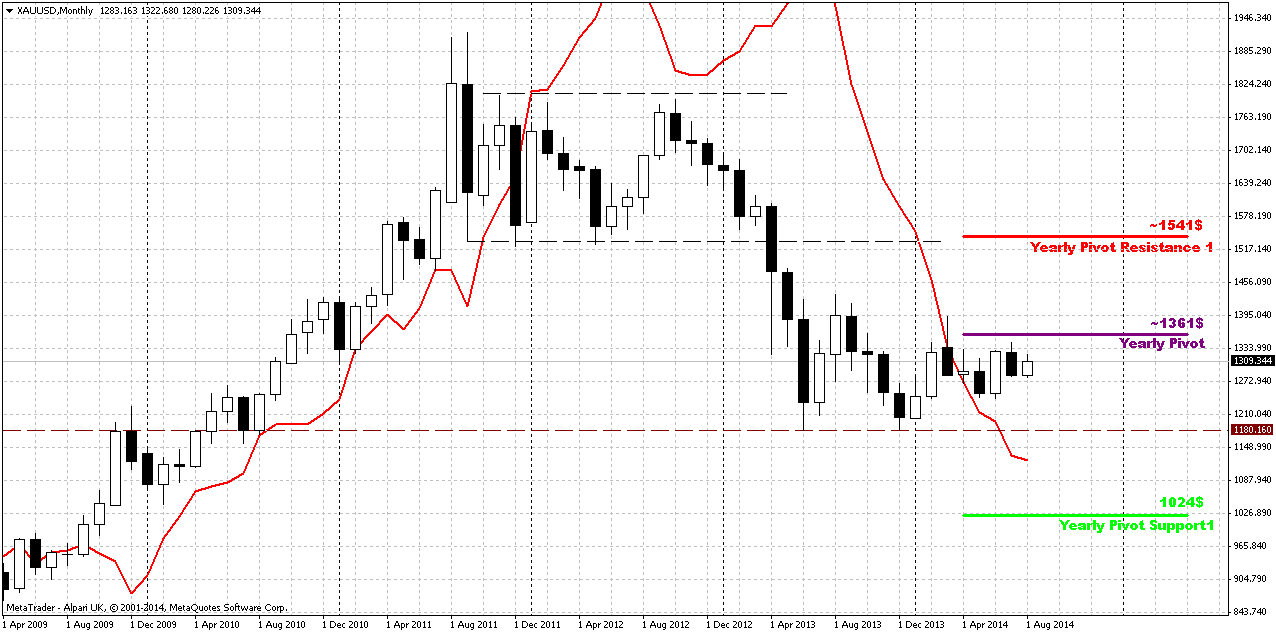

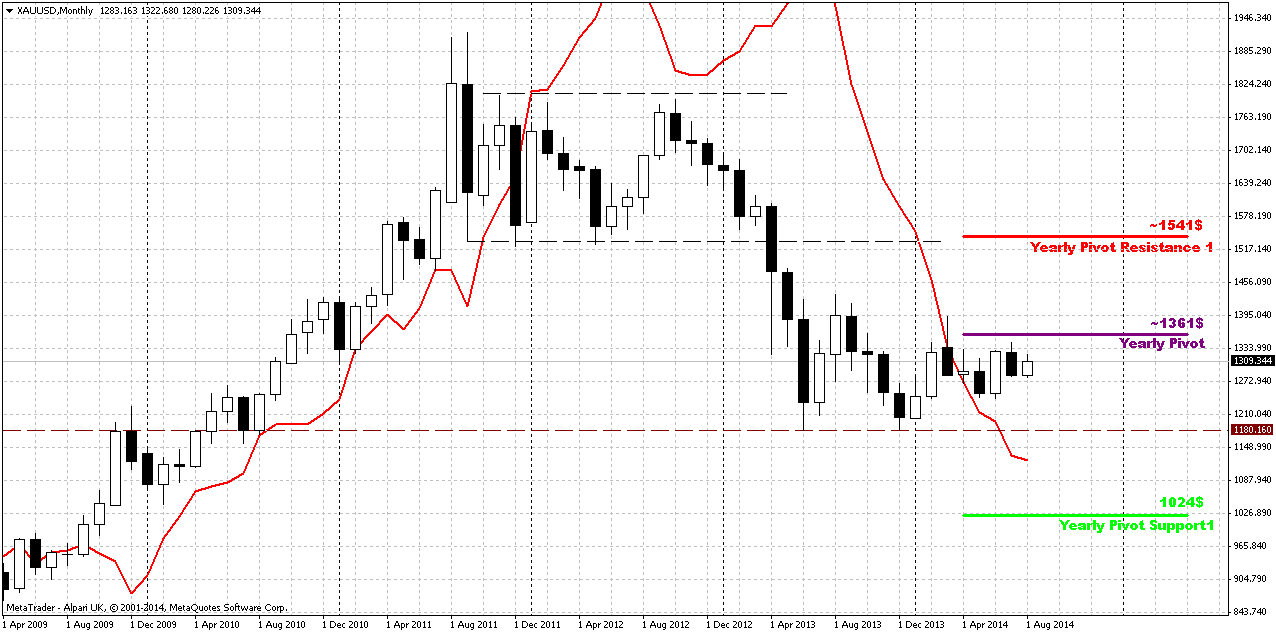

Monthly

Gold fell on Friday, pressured by a lack of physical buyers and gains on

Wall Street, but a U.S. air strike in Iraq and tensions in Middle East

supported prices, which stayed above $1,300 an ounce. Gold was up around

1 percent for the week, its first weekly increase in four weeks. In

early trade, gold rallied to a three-week high on news U.S. aircraft

bombed Islamic fighters marching on Iraq's Kurdish capital of Arbil.

safe-haven buying dried up after Russia's Defense Ministry said it had

finished military exercises near its border with Ukraine. That news sent

the S&P 500 equities index about 1 percent higher.

Earlier this year, gold rallied to just below $1,400 an ounce as tensions mounted between Russia and the West over Ukraine. Gold had unwound most of those gains in two weeks.

"It's difficult to get overly excited given gold's multiple failures to consistently rally on geo-political events, especially when the volumes behind this move have been rather light," said Edel Tully, precious metals strategist at UBS.

Bullion was pressured by data showing a strong second-quarter rebound in productivity at U.S. nonfarm businesses, reducing wage pressures and allowing the Federal Reserve to keep interest rates low.

Physical demand has not been strong enough to support prices after gold's 3 percent jump in the last three sessions. Gold premiums in top buyer China have been stuck at $2-$3 an ounce and demand is much weaker than last year, dealers said.

Earlier this year, gold rallied to just below $1,400 an ounce as tensions mounted between Russia and the West over Ukraine. Gold had unwound most of those gains in two weeks.

"It's difficult to get overly excited given gold's multiple failures to consistently rally on geo-political events, especially when the volumes behind this move have been rather light," said Edel Tully, precious metals strategist at UBS.

Bullion was pressured by data showing a strong second-quarter rebound in productivity at U.S. nonfarm businesses, reducing wage pressures and allowing the Federal Reserve to keep interest rates low.

Physical demand has not been strong enough to support prices after gold's 3 percent jump in the last three sessions. Gold premiums in top buyer China have been stuck at $2-$3 an ounce and demand is much weaker than last year, dealers said.

Natixis analyst Bernard Dahdah said gold prices would be much lower

without geopolitical factors because Asian physical buying and U.S.

investment demand were both lagging.

CFTC data currently very important and gives us necessary information.

Thus on previous week Open Interest has dropped again significantly. Net

long position also has decreased. It could mean that investors close

longs more than short positions.

Monthly

Market has moved slightly higher on previous week, still price should

pass solid distance to change situation drastically. it could change

only if market will move above 1400 area. Reson for rally was suspicious

– Russia has started military exercises near Ukraine’s border and Obama

gave an order to start Air strikes in north Iraq. As we said in our

daily updates – it looks like gold has tired to wait and catches any

more or less valuable news to show action.

Since currently August mostly is an inside month for July our former analysis is still working. Althgough investors have not got hawkish hints from Fed and recent NFP data was slightly lower than analysts poll, major factors are still valid - good economy data, that right now is confirmed by US companies earning reports, week physical demand – all these moments prevent gold appreciation. The only factor that could support gold somehow is gepolitical tensions. Previously we have turmoil in Iraq and Ukraine, now Israel and Palestine added.

Grabber pattern is important, but June, and especially July has blocked gradual downward action and white candles break the bearish harmony of recent action. Next upside important level is 1360 – Yearly pivot point. If market will move above it – this could be an indication that gold will continue move higher and this really could become a breaking moment on gold market. Otherwise, grabber will be valid and potentially could lead price back at least to 1180 lows again.

That’s being said, situation on the monthly chart does not suggest yet taking long-term positions on gold. Still, fundamental picture is moderately bearish in long-term. Possible sanctions from EU and US could hurt their own economies (especially EU). Many analysts already have started to talk about it. It means that economies will start to loose upside momentum and inflation will remain anemic. In such situations investors mostly invest in interest-bear assets, such as bonds. Inflation also will be depressed and this is negative sign for gold. At the same time we do not want to say that situation is cloudless for bears, absolutely not. Especially due to the pattern that we’ve got on weekly chart…

Since currently August mostly is an inside month for July our former analysis is still working. Althgough investors have not got hawkish hints from Fed and recent NFP data was slightly lower than analysts poll, major factors are still valid - good economy data, that right now is confirmed by US companies earning reports, week physical demand – all these moments prevent gold appreciation. The only factor that could support gold somehow is gepolitical tensions. Previously we have turmoil in Iraq and Ukraine, now Israel and Palestine added.

Grabber pattern is important, but June, and especially July has blocked gradual downward action and white candles break the bearish harmony of recent action. Next upside important level is 1360 – Yearly pivot point. If market will move above it – this could be an indication that gold will continue move higher and this really could become a breaking moment on gold market. Otherwise, grabber will be valid and potentially could lead price back at least to 1180 lows again.

That’s being said, situation on the monthly chart does not suggest yet taking long-term positions on gold. Still, fundamental picture is moderately bearish in long-term. Possible sanctions from EU and US could hurt their own economies (especially EU). Many analysts already have started to talk about it. It means that economies will start to loose upside momentum and inflation will remain anemic. In such situations investors mostly invest in interest-bear assets, such as bonds. Inflation also will be depressed and this is negative sign for gold. At the same time we do not want to say that situation is cloudless for bears, absolutely not. Especially due to the pattern that we’ve got on weekly chart…

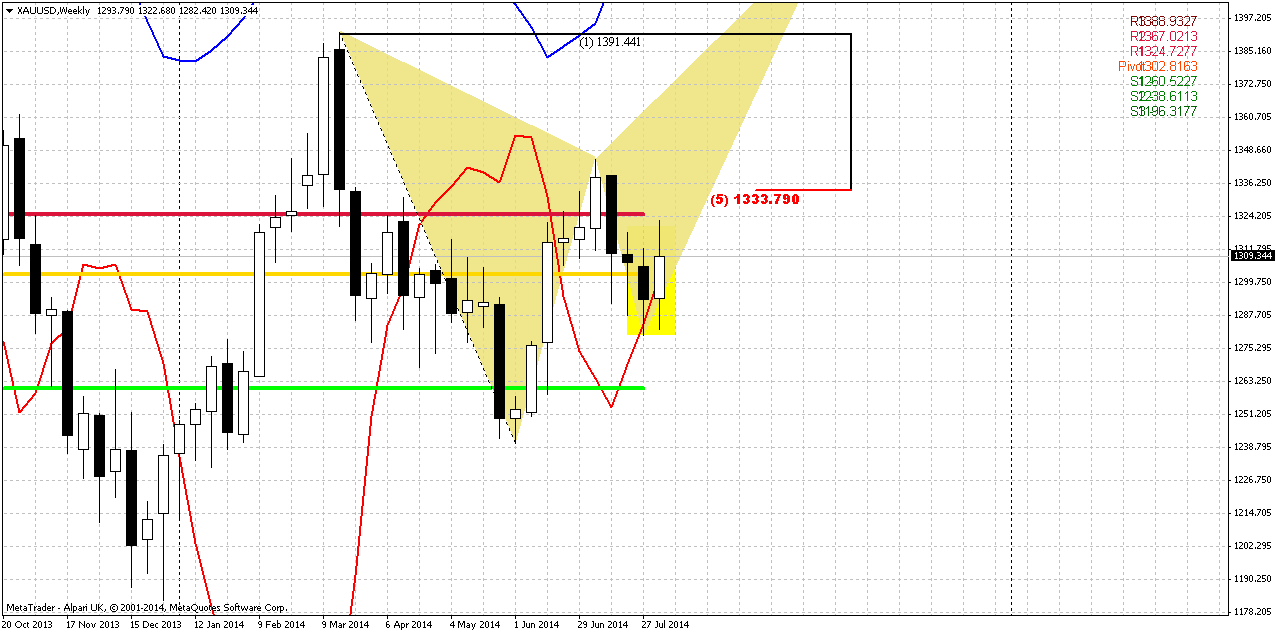

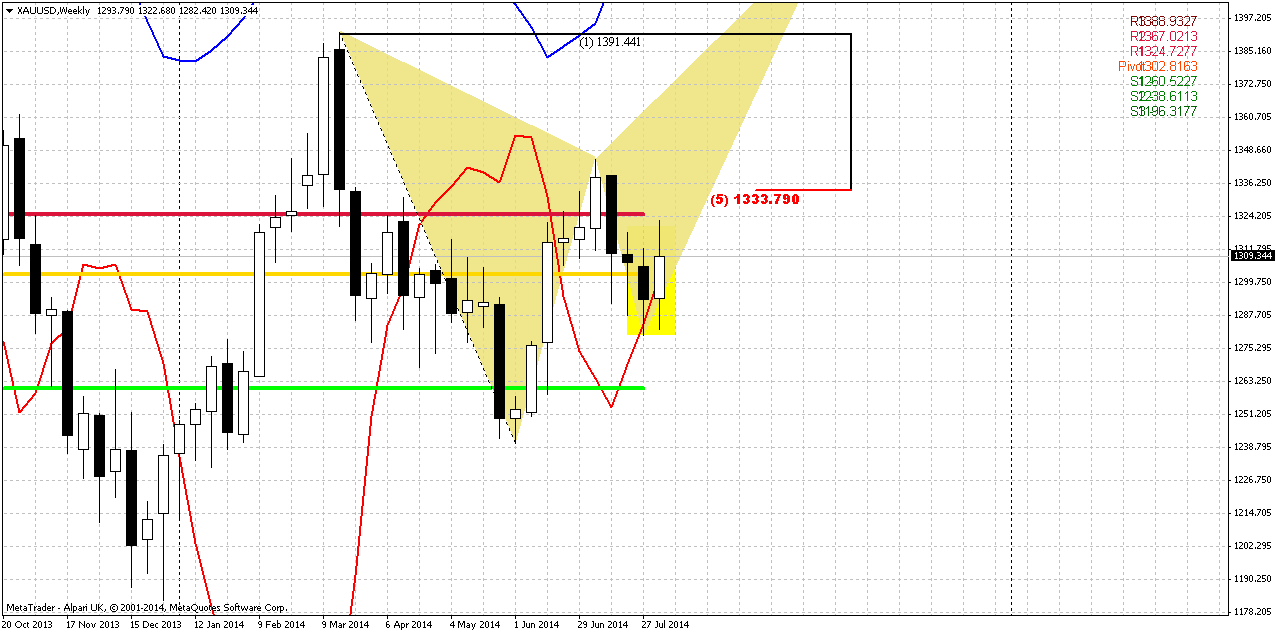

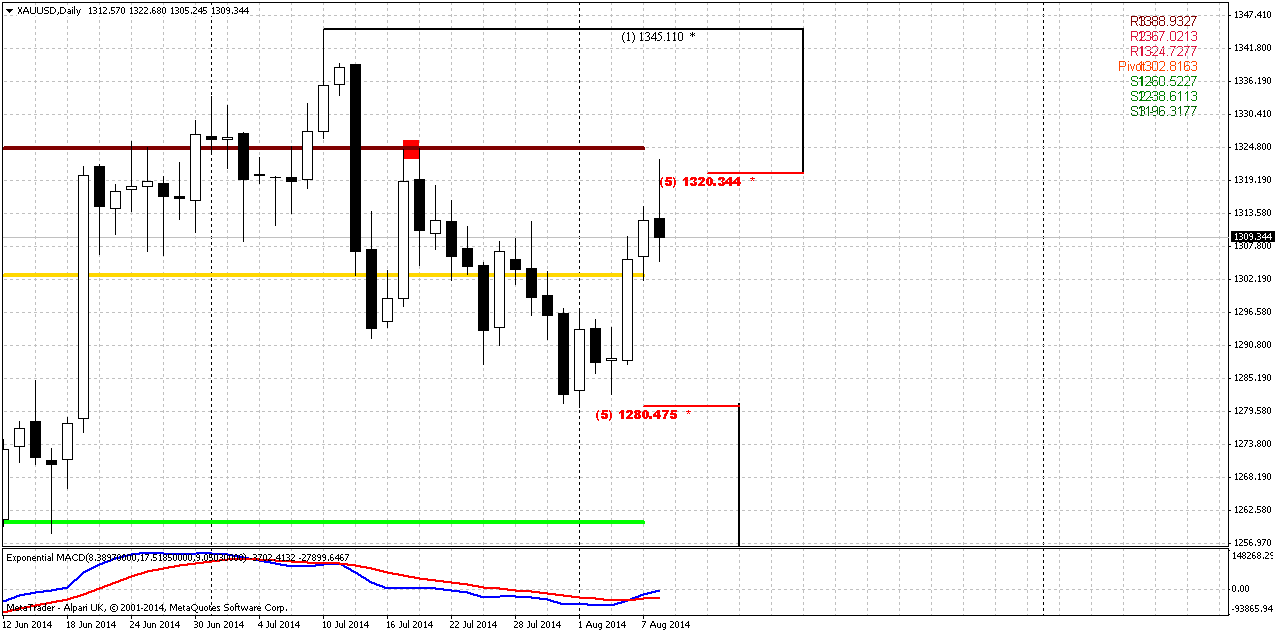

Weekly

Weekly chart is a goldmine of potential patterns. As we just have

finished discussion of first bullish grabber on previous week – now

we’ve got another one, and its minimum target stands above 1350 area,

very close to YPP ~ 1360. Trend is bullish here. Possible success of

grabber has very important meaning for strategic picture. Recall that

previously we’ve discussed weekly bearish AB=CD and 1250 lows is 0.618

target. Recent upward move to 1345 area could be treated as retracement

and then market re-established downward action. But if right now

grabbers will work – market will have to return right back up again and

this contradicts to normal bearish development. This could really shift

medium term sentiment to bullish. To keep bearish setup – price should

erase grabbers and move below its lows.Second bullish moment here – gold has tested and moved above MPP. So, conclusion here is until grabbers’ lows hold – it is unsafe to take bearish position. Besides, seasonal trend will shift bullish at the end of August and lasts till the late February:

Thus if you’re bearish - it is better to wait when market will done with grabbers. Others could try to ride on grabbers.

And finally, just to finish with this picture... Since action above 1350 area will mean probably erasion of weekly bearish patterns and context – market could not just stop on minor target. For example, appearing of butterfly here with ~1430$ destination point is not absolutely impossible thing.

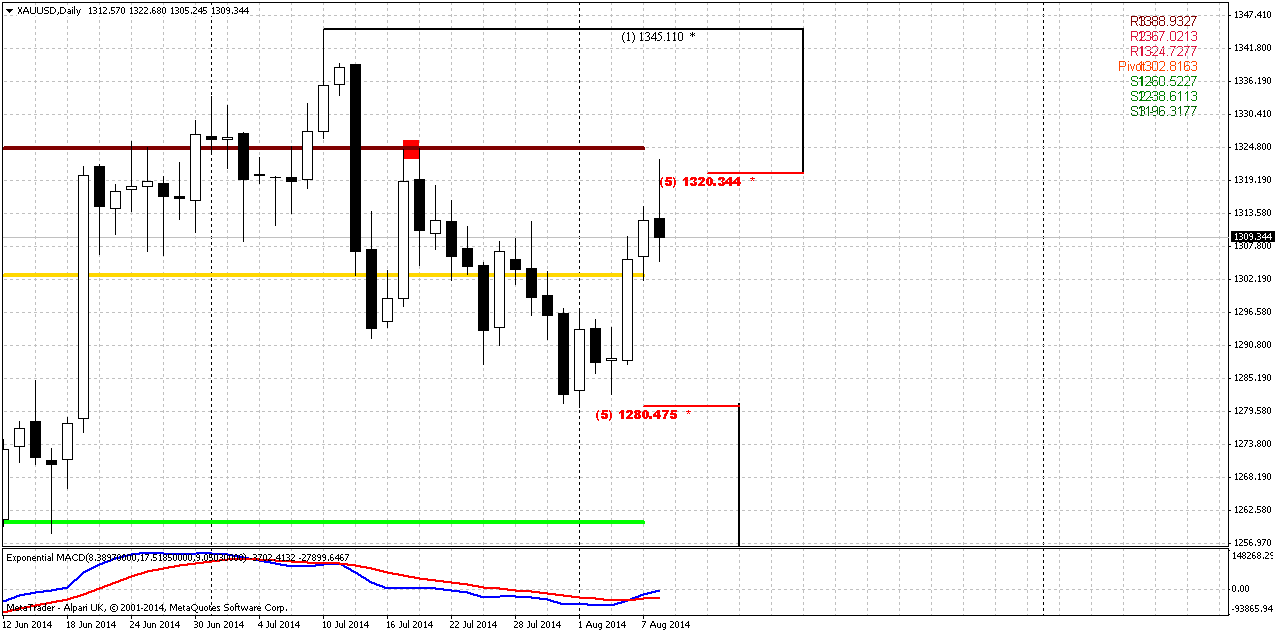

DailyAnd finally, just to finish with this picture... Since action above 1350 area will mean probably erasion of weekly bearish patterns and context – market could not just stop on minor target. For example, appearing of butterfly here with ~1430$ destination point is not absolutely impossible thing.

So, guys, I would like to felicitate us, because situation on gold

market stands clear right now. I do not want to say that it will be

simple to trade it, but, at least we have clarity in short-term

perspective. Thus, since first - we’ve estimated that’s a bit early, or,

at least, unsafe to enter short. Hence, we can either enter long or do

nothing. If we will enter long – we just need only recent swing up on

daily chart, because this is a swing of our weekly grabbers. If market

will erase this swing – it will erase grabbers also and our trading

context will disappear as well, right? Consequently, we need just watch

for most recent lows as invalidation point and try to take long position

as close to them as possible.

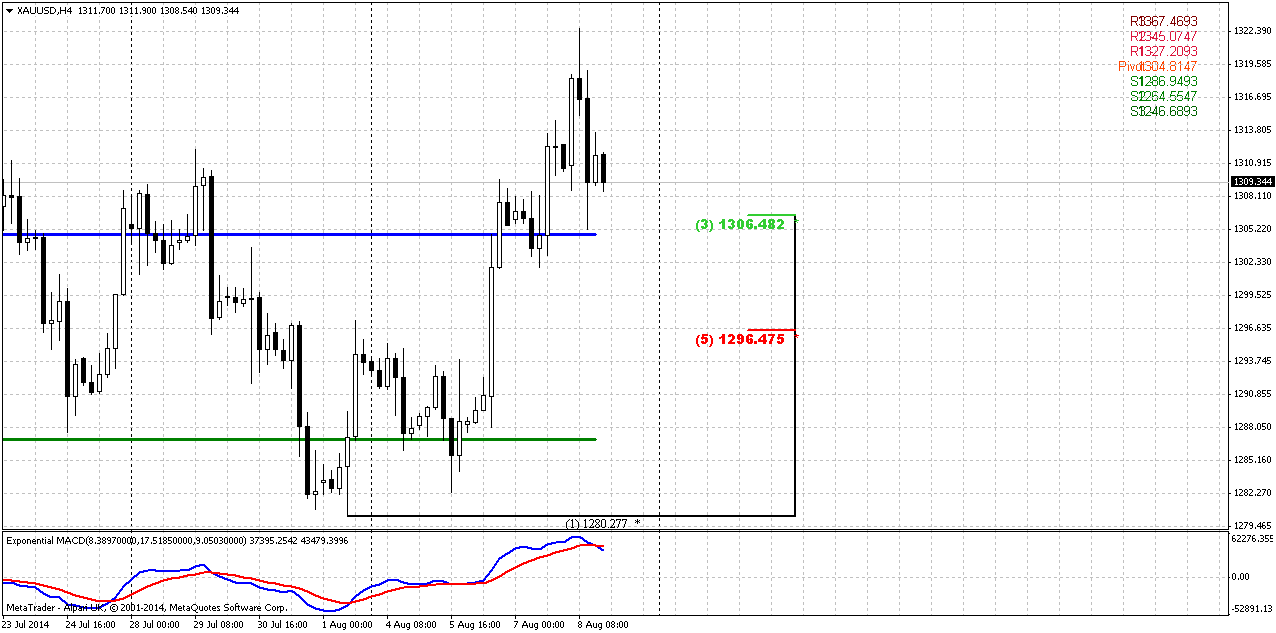

Previously we’ve mentioned some concerns on existed downward AB-CD patterns that were not completed properly. But right now minor (4-hour) AB-CD has been erased, since price has moved above C point. Daily AB-CD still exists, and this will be our task – it would be nice if price will take out top in red square on chart. In this case all our concerns will be resolved. On daily chart trend is bullish as well. As we’ve said on Friday – since market has reached 5/8 Fib resistance, MPR1 – retracement could start and this has happened.

Previously we’ve mentioned some concerns on existed downward AB-CD patterns that were not completed properly. But right now minor (4-hour) AB-CD has been erased, since price has moved above C point. Daily AB-CD still exists, and this will be our task – it would be nice if price will take out top in red square on chart. In this case all our concerns will be resolved. On daily chart trend is bullish as well. As we’ve said on Friday – since market has reached 5/8 Fib resistance, MPR1 – retracement could start and this has happened.

4-hour

Trend has turned bearish here. Market stands with retracement down. Our

first point to watch for is 1305 area. It should be re-tested and this

almost has happened on Friday. This area is broken without any respect

daily K-resistance and odds suggest it re-testing from other side.

Second area to watch for – 1296 Fib support. We can’t exclude that

retracement will be deep and this probably even better from risk/reward

point of view.

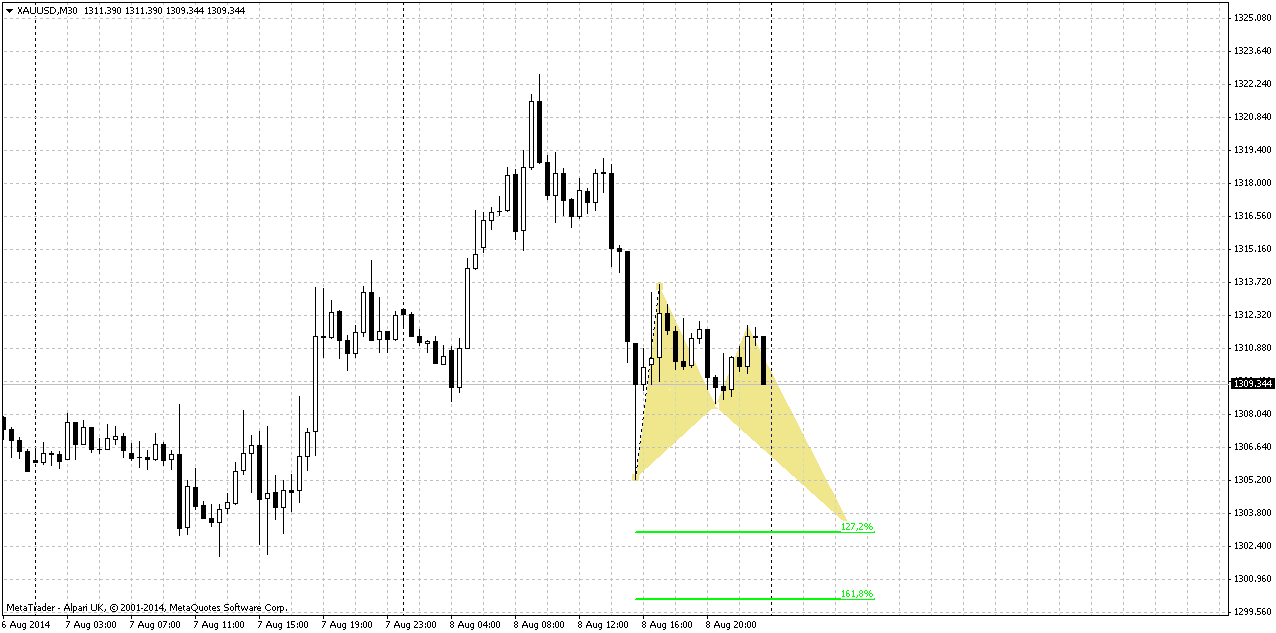

30-min

Currently guys, it is difficult to find any clear patterns on lower

chart. You can argue and point that this shape reminds H&S pattern,

well, may be. But ratios are not very perfect among head and shoulders.

Thus, it would be better probably to focus on this butterfly initally.

It has destination points that are very close to our Fib support levels.

Situation on gold market remains sophisticated. Despite some obviously bearish moments, such as bullish

USD sentiment, lack of physical demand, gold does not show real

downward acceleration and we could see that gold troubles downward

action. Definitely that there are some reasons for that and they

probably are not limited by just geopolitical tensions.

In this situation it is better to work on definite patterns, such as grabber that we’ve got on weekly chart.

In short term perspective situation is relatively clear. As we’ve estimated that it is better to not go against weekly grabbers – we can either do nothing or try to trade grabbers to the upside. How to do it we’ve discussed on daily and intraday charts.

In this situation it is better to work on definite patterns, such as grabber that we’ve got on weekly chart.

In short term perspective situation is relatively clear. As we’ve estimated that it is better to not go against weekly grabbers – we can either do nothing or try to trade grabbers to the upside. How to do it we’ve discussed on daily and intraday charts.

Samer Al Reifae

support5002@vantagefx.com

http://www.vantagefx.com/products/spreads

https://www.facebook.com/LORDOFTRUTH

https://www.facebook.com/FollowTheRaw

https://www.facebook.com/groups/vantagefx/

http://lordoftruth.blogspot.com/

See Why VantageFx ?

_Trade with Winners:

Australian financial service providers, Vantage FX,

have received a multitude of awards over the years including those from IB Times,

Deal Makers, The World Finance Foreign Exchange Awards, Smart Investor and many more.

_Vantage FX have:

Award-winning Execution Speeds

Competitive spreads from 0.0 pips

24/5 Premium Customer Support

_Trade with Choice:

Take your pick. Choose from -->

32 Forex currency pairs

Major indices including SPI200, S&P500, DJ30

Commodities – gold, silver and crude oil

Binary Options – click here to read more about this exciting, new way to trade

_Trade with flexibility:

Choose your leverage amount ranging from 1:1 to 500:1

Choose your lot size - micro, mini or standard lots

Choose your account type – Standard or Pro, Individual or Joint

_Trade Your Way:

Choose the trading solution that matches your trading style:

The popular MetaTrader 4 (MT4)

MT4 for Mac – Exclusive to Vantage FX in Australia

MetaTrader 5

WebTrader

Mobile trading apps for iPhone, iPad and Android

Social trading via FX Copy

_Trade Securely and with Transparency:

No Dealing Desk Execution. No Requotes

100% Straight Through Processing

ASIC Regulated Standards

Funds Secure in Segregated Client Accounts at NAB

_Trade Wisely:

Daily market analysis from our key expert writer and currency strategist, Greg McKenna

Daily Forex Currency Highlights reports

Learn, follow and copy leading successful traders on FX Copy

Free Autochartist tools for live Vantage FX account holders

Free webinars and access to webinar archives

Other educational resources including infographics, glossary and guides

Samer Al Reifae

support5002@vantagefx.com

https://www.facebook.com/LORDOFTRUTH

https://www.facebook.com/FollowTheRaw

https://www.facebook.com/groups/vantagefx/

http://lordoftruth.blogspot.com/

_Trade with Winners:

Australian financial service providers, Vantage FX,

have received a multitude of awards over the years including those from IB Times,

Deal Makers, The World Finance Foreign Exchange Awards, Smart Investor and many more.

_Vantage FX have:

Award-winning Execution Speeds

Competitive spreads from 0.0 pips

24/5 Premium Customer Support

_Trade with Choice:

Take your pick. Choose from -->

32 Forex currency pairs

Major indices including SPI200, S&P500, DJ30

Commodities – gold, silver and crude oil

Binary Options – click here to read more about this exciting, new way to trade

_Trade with flexibility:

Choose your leverage amount ranging from 1:1 to 500:1

Choose your lot size - micro, mini or standard lots

Choose your account type – Standard or Pro, Individual or Joint

_Trade Your Way:

Choose the trading solution that matches your trading style:

The popular MetaTrader 4 (MT4)

MT4 for Mac – Exclusive to Vantage FX in Australia

MetaTrader 5

WebTrader

Mobile trading apps for iPhone, iPad and Android

Social trading via FX Copy

_Trade Securely and with Transparency:

No Dealing Desk Execution. No Requotes

100% Straight Through Processing

ASIC Regulated Standards

Funds Secure in Segregated Client Accounts at NAB

_Trade Wisely:

Daily market analysis from our key expert writer and currency strategist, Greg McKenna

Daily Forex Currency Highlights reports

Learn, follow and copy leading successful traders on FX Copy

Free Autochartist tools for live Vantage FX account holders

Free webinars and access to webinar archives

Other educational resources including infographics, glossary and guides

Samer Al Reifae

support5002@vantagefx.com

https://www.facebook.com/LORDOFTRUTH

https://www.facebook.com/FollowTheRaw

https://www.facebook.com/groups/vantagefx/

http://lordoftruth.blogspot.com/

Get the newly designed trading tools package that can enhance your

trading and assist you in achieving your trading goals. Maximize returns

and discover new trading opportunities with this wide range of

seriously advanced tools.

What is the SmartTrader Tools Package?

Nine unique and powerful trading tools completely designed for MetaTrader 4 (MT4) and available in one user-friendly, easy-to-install package. The package includes:

Sentiment Trader

At a quick glance, see what the general sentiment is and trade directly within the same window

Correlation Trader

Determine correlation patterns between pairs in one app with key figures & notes

Session Map

A visual world sessions map synced to your local time-zone with calendar events

Trade Terminal

Advanced trade execution and analysis tool for quick, precision trading

Excel RTD Link

The bridging tool for Excel pros allowing you trade from Excel based trading rules

Alarm Manager

Go beyond just receiving alerts. Automatically trigger orders or close trades based on your pre-set rules.

Correlation Matrix

A flexible and comprehensive matrix grid. See at a glance correlation scores and the strength of patterns.

Market Manager

Customise and create a Market Watch window with different layout options

Connect Panel

Your personal pick of news feeds and Binary Options trading direct from MT4

How do you get the package free?

Visit our SmartTrader Tools webpage for more information on each tool and how to register.

Why Vantage FX?

Trade with Winners

Australian financial service providers, Vantage FX, have received a multitude of awards over the years including those from IB Times, Deal Makers, The World Finance Foreign Exchange Awards, Smart Investor and many more.

Vantage FX have

Award-winning Execution Speeds

Competitive spreads from 0.0 pips

24/5 Premium Customer Support

The Gold Price & Trend Predictions blog made for gold traders to find good news and to provide the traders with daily price predictions and to learn how to trade the Forex Market for free.Just pure learning! It will be of great fun.You can judge by yourself the quality of information that I will be giving you in my blog.

Welcome to my blog where you can learn how to trade the Forex Market for free.The material is all created by myself and not copied from anywhere. There is a lot yet to come since there is a lot that you need to learn, and there is a lot that I need to share with you! So please just be patient – it will be worth it.You can judge by yourself the quality of information that I will be giving you . So just go now and start learning!

Below is a quick guide of how this website is structured, so you can find what you are looking for fast. Remember that I update the pages every day so either check back often.

In this section you will find quite a long article of what Forex is all about. If you are a beginner, this is a must read. It explains in detail what is required to start trading, what you should do and not, typical traps to avoid as a beginner and a lot of valuable information which you as a beginner must digest and learn prior opening any Forex account with real money.

In this section you will find your road map on how to become a real successful trader couple of months as from today.

In this section you will know the 3 major areas – Technical Analysis, Fundamental Analysis and Trading Physcology.

In this section you will find a gold mine of information about the technicalities of Forex. We will start from the very basics covering all the Forex jargon words which you will be hearing every day and we will be taking you up to the level required to finally learn to trade like a pro – technical analysis, also found in this section.

In this section you will see the tips that will help you stay away from crap forex products, which unfortunately the Forex market is invaded with.

This section has a very detailed article on how to avoid being scammed in this ruthless world of Forex. I will explain in detail six tips that you need to look for prior purchasing any products. Even though most of the time you may claim your money back,the time wasted is never returned. You should have used that time to learn how to trade! Read it!

YOU SHOULD NOT TAKE ANY MATERIAL posted on this BLOG AS RECOMMENDATIONS

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

Do your own due diligence.

No one knows tomorrow's price or circumstance.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.

King Regards