Follow The Raw

Fundamentals

Weekly

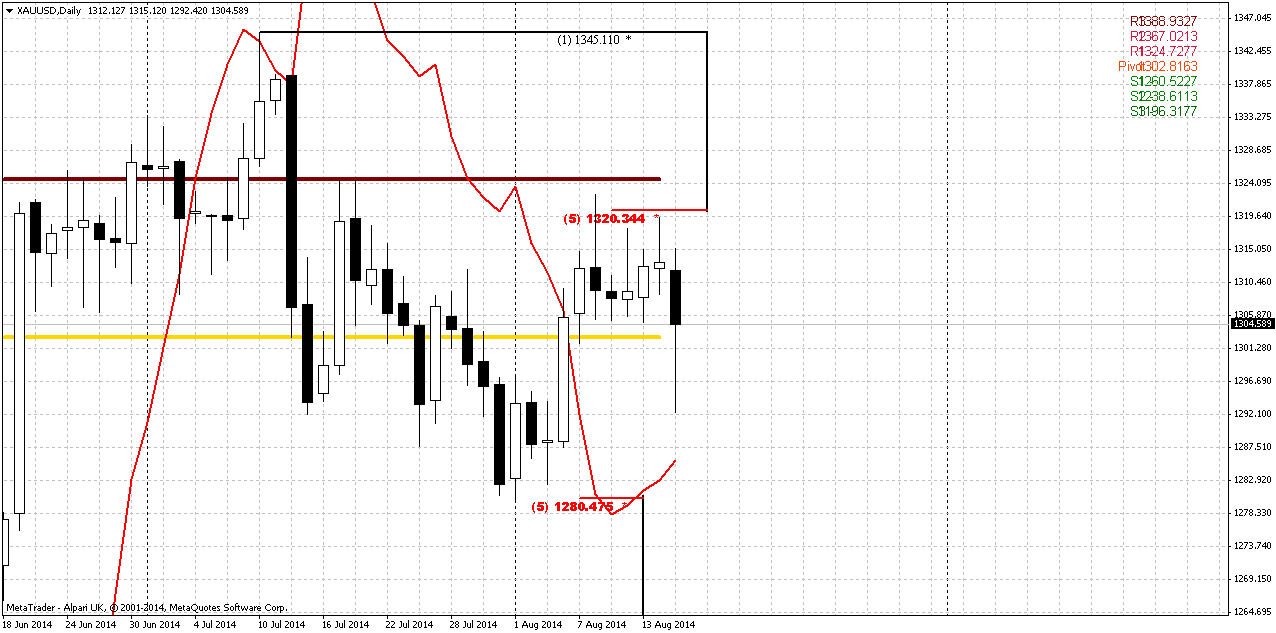

Daily

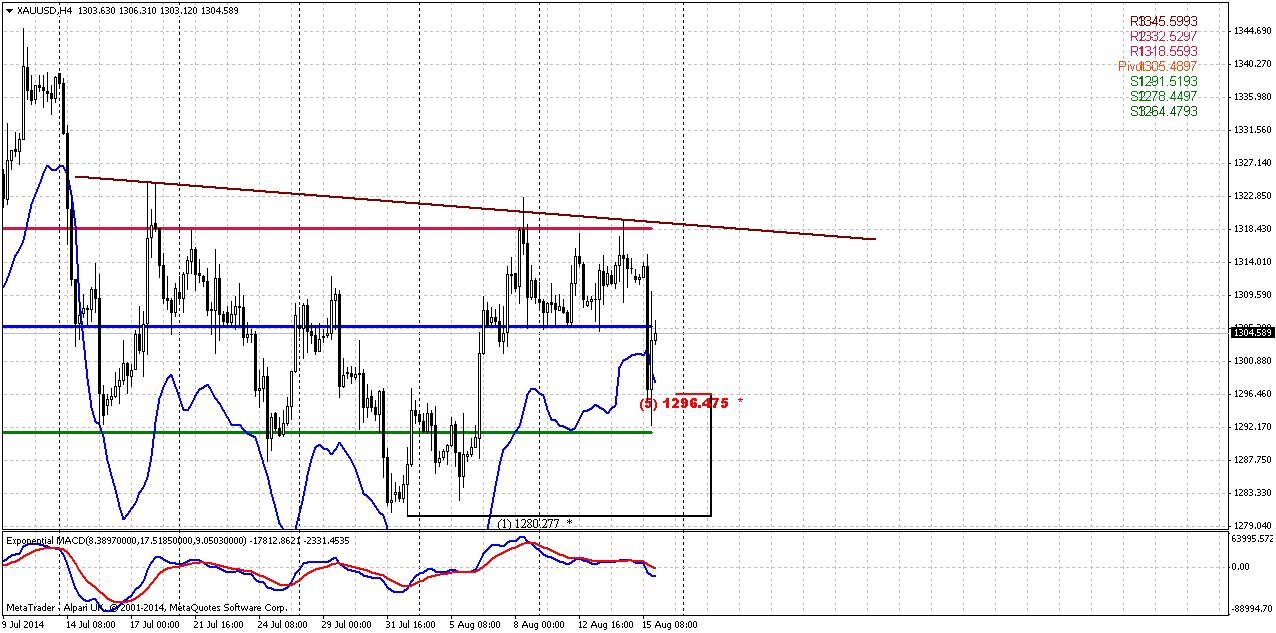

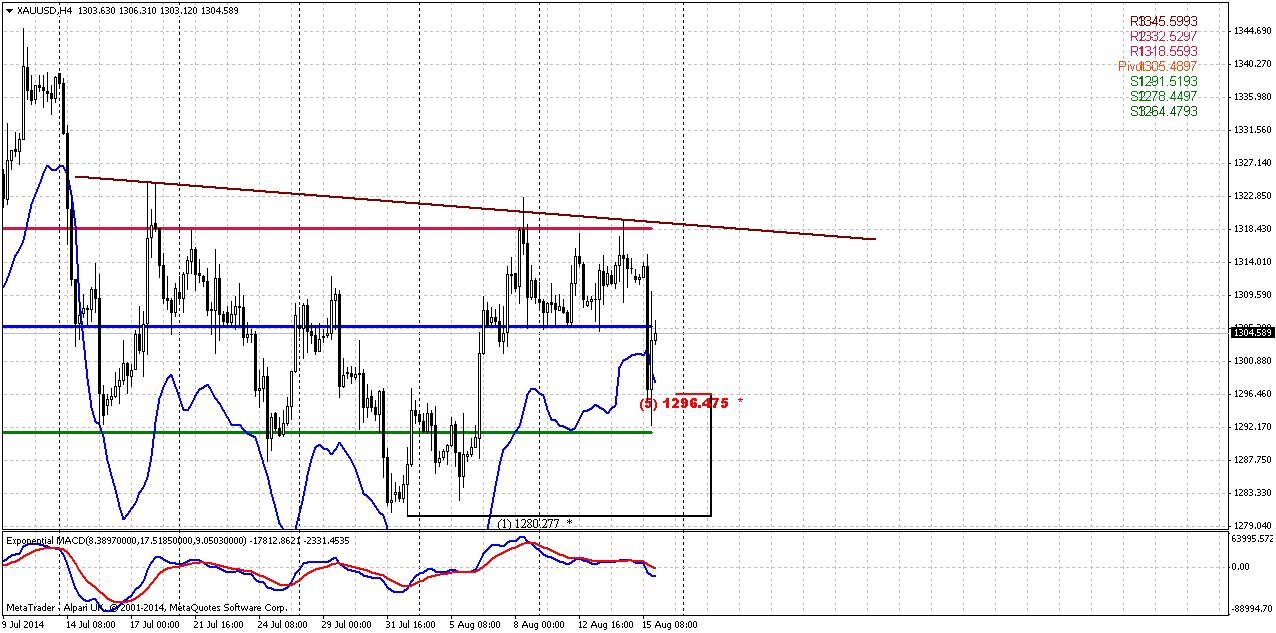

4-hour

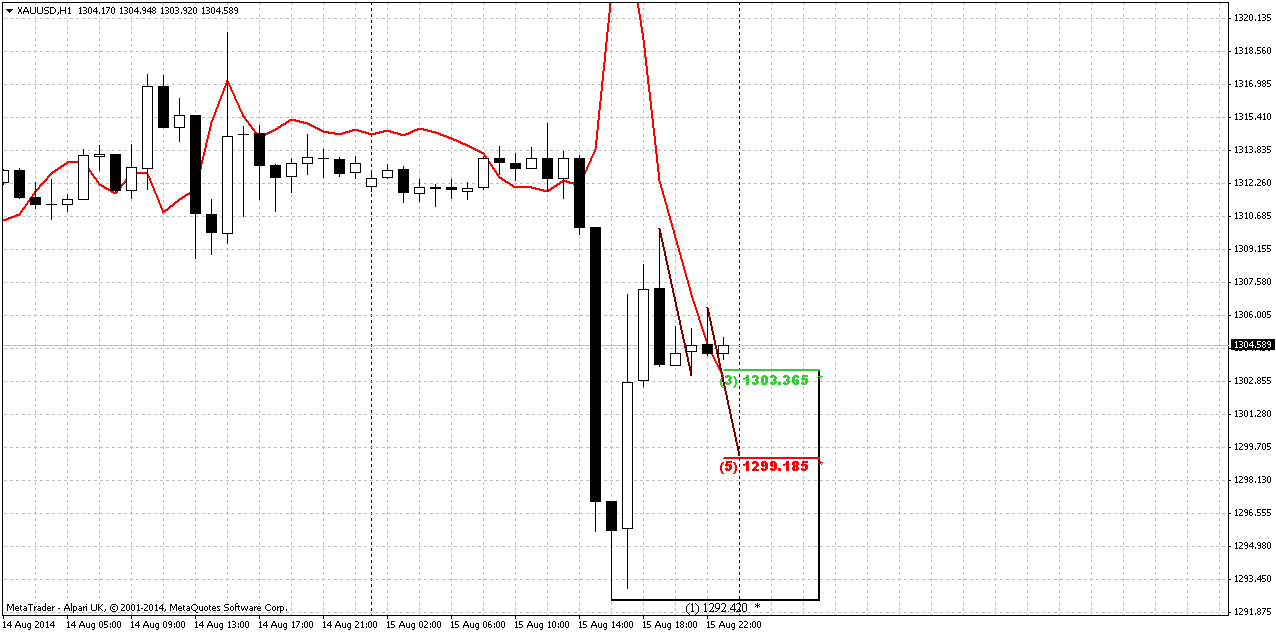

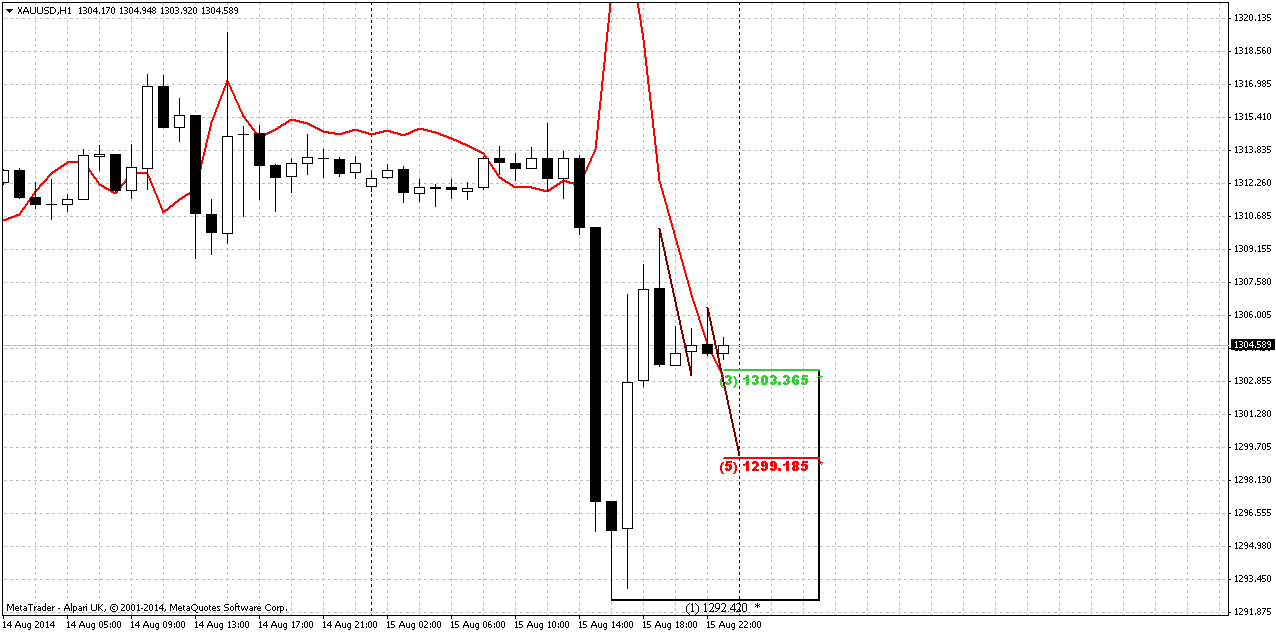

1-hour

Fundamentals

Gold prices were slightly lower on Friday, paring losses on safe-haven

buying as equity markets slid after Ukraine said its forces had engaged a

Russian armored column on Ukrainian soil in what appeared to be a major

military escalation. Investors bought bullion and U.S. Treasuries after

Ukraine said its forces had attacked and partly destroyed a Russian

armored column that crossed into Ukrainian territory. Moscow said its

forces had not crossed into Ukraine, and accused Kiev of trying to

sabotage deliveries of aid.

"The news definitely helps gold reverse higher and shows that gold is

very susceptible to geopolitical tensions," said Phillip Streible,

senior commodities broker at RJ O'Brien. "When these developments cool,

you will see the gold market come right back down."

Earlier in the session, bullion was down more than 1 percent because of

weak physical demand, gains in U.S. equities and weak U.S. producer inflation data. But stocks fell after the news from Ukraine, while benchmark 10-year U.S. Treasury bond prices rose.

Technical support could further lift prices after gold breached its 50- and 100-day moving averages following Friday's rally.

In gold investment news, hedge fund Paulson & Co maintained its

stake in the world's biggest gold-backed exchange-traded fund, SPDR Gold

Trust, in the second quarter, while Soros Fund Management LLC sharply

boosted its investment in gold mining stocks.

Among other precious metals, silver was down 1.4 percent at $19.52 an

ounce. The silver market entered a new era in benchmarking on Friday

after a regulatory drive for more transparency in price setting brought

the 117-year-old silver 'fix' to an end.

CFTC

data currently very is important. Most recent data shows solid increase

in net long position as well as jump in open interest. Of cause, we do

not know, may be this was just due fake information on Russian military

forces destruction or this is just single episode - anyway we need to

get some graduality in this tendency. But even this single moment shows

that new money comes on market on previous week and this is also support

factor for our medium term bullish analysis.

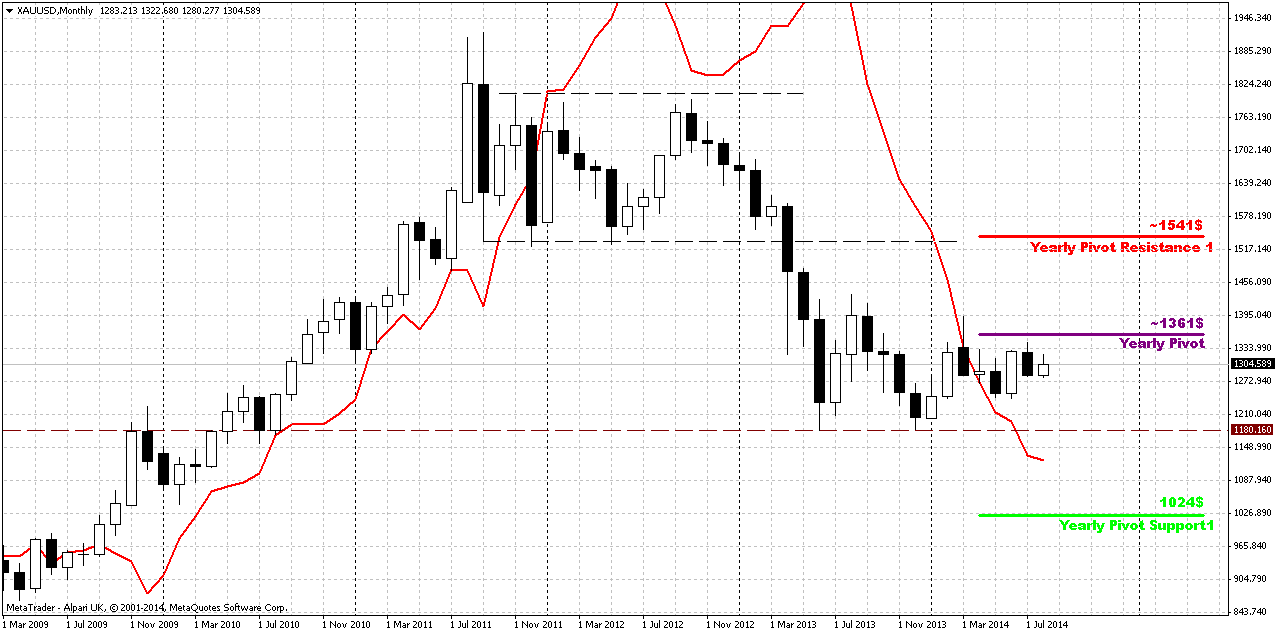

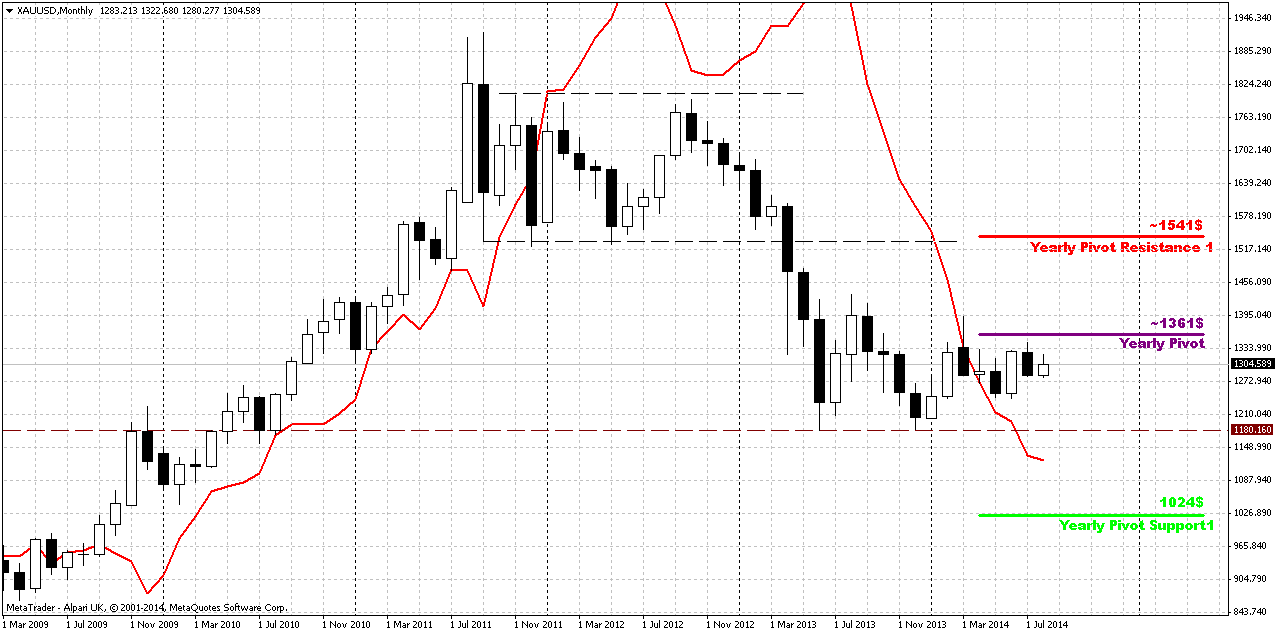

Monthly

As we’ve mentioned previously price should pass solid distance to change

situation drastically. it could change only if market will move above

1400 area. On current week reason for rally again was suspicious, as

we’ve pointed the reason above. Gold right now has tired to wait and

catches any more or less valuable news to show action. Still, it is

possible that there are some features under curtain that we do not see

right now. Because usually solid surge in Open interest and Net long

position hardly happens occasionally or just on rumor of geopolitical

event that was fastly belied.

Since currently August mostly is an inside month for July our former

analysis is still working. Although investors have not got hawkish hints

from Fed and recent NFP data was slightly lower than analysts poll,

major factors are still valid - good economy data, that right now is

confirmed by US companies earning reports, weak physical demand – all

these moments prevent gold appreciation. At the same time there are two

factors that could support gold soon – seasonal trend, geopolitical

tensions. And in general, guys, current level are not bad in general for

partial long-term purchases. This thought is confirmed by Soros fund

that has increased investing in gold shares. Besides, US data is a

subject to change. Currently it looks good, let’s see on Fed minutes and

Jackson Hole meeting. But appearing of signs of inflation could add

fuel to gold.

Bearish grabber pattern is important, but June, and especially July has

blocked gradual downward action and white candles break the bearish

harmony of recent action. Next upside important level is 1360 – Yearly

pivot point. If market will move above it – this could be an indication

that gold will continue move higher and this really could become a

breaking moment on gold market. Otherwise, grabber will be valid and

potentially could lead price back at least to 1180 lows again.

That’s being said, situation on the monthly chart does not suggest yet

taking long-term positions on gold. Still, fundamental picture is

moderately bearish in long-term. Possible sanctions from EU and US could

hurt their own economies (especially EU). Many analysts already have

started to talk about it. It means that economies will start to loose

upside momentum and inflation will remain anemic. In such situations

investors mostly invest in interest-bear assets, such as bonds.

Inflation also will be depressed and this is negative sign for gold. At

the same time we do not want to say that situation is cloudless for

bears, absolutely not. Especially due to the pattern that we’ve got on

weekly chart…

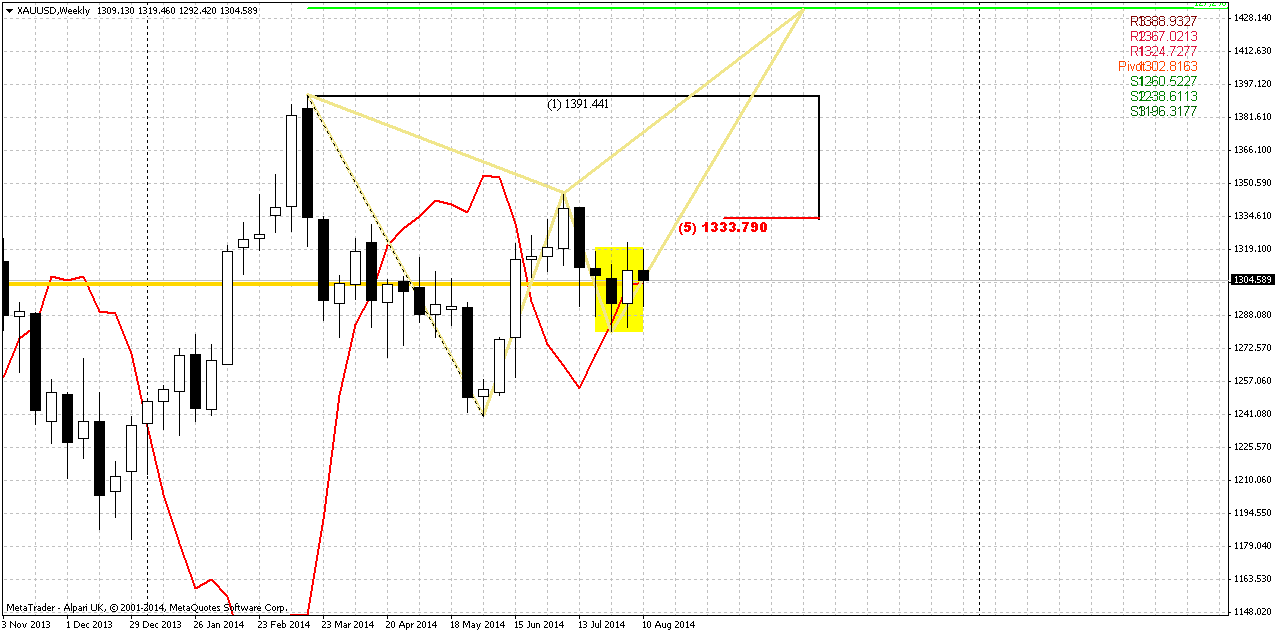

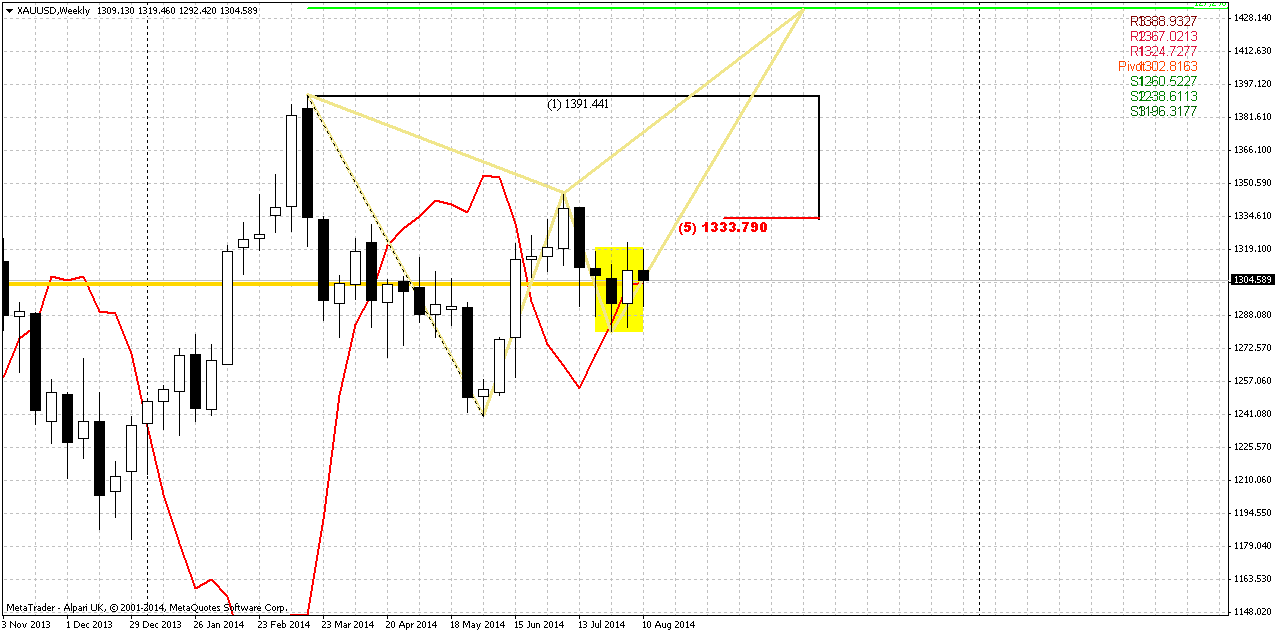

Weekly

Although monthly picture is moderately bearish and market needs to

exceed 1400 to change it, but in medium-term perspective market mostly

bullish, at least due patterns that we have on weekly chart. In general

analysis is the same and has become even stronger since we’ve got

another bullish grabber. Thus we have 3 weekly grabbers in a row.

Weekly chart is a goldmine of potential patterns. Minimum target of

grabbers stands above 1350 area, very close to YPP ~ 1360. Trend is

bullish here as on monthly chart. Possible success of grabber has very

important meaning for strategic picture. Recall that previously we’ve

discussed weekly bearish AB=CD and 1250 lows is 0.618 target. Recent

upward move to 1345 area could be treated as retracement and then market

re-established downward action. But if right now grabbers will work –

market will have to return right back up again and this contradicts to

normal bearish development. This could really shift medium term

sentiment to bullish. To keep bearish setup – price should erase

grabbers and move below its lows.

Second bullish moment here – gold has tested and moved above MPP and

still holds above it. So, conclusion here is until grabbers’ lows hold –

it is unsafe to take bearish position. Besides, seasonal trend will

shift bullish at the end of August and will last till the late February

of 2015:

Thus if you’re bearish - it is better to wait when market will done with grabbers. Others could try to ride on grabbers.

And finally, just to finish with this picture... Since action above 1350

area will mean probably erasion of weekly bearish patterns and context –

market could not just stop on minor target. For example, appearing of

butterfly here with ~1430$ destination point is not absolutely

impossible thing.

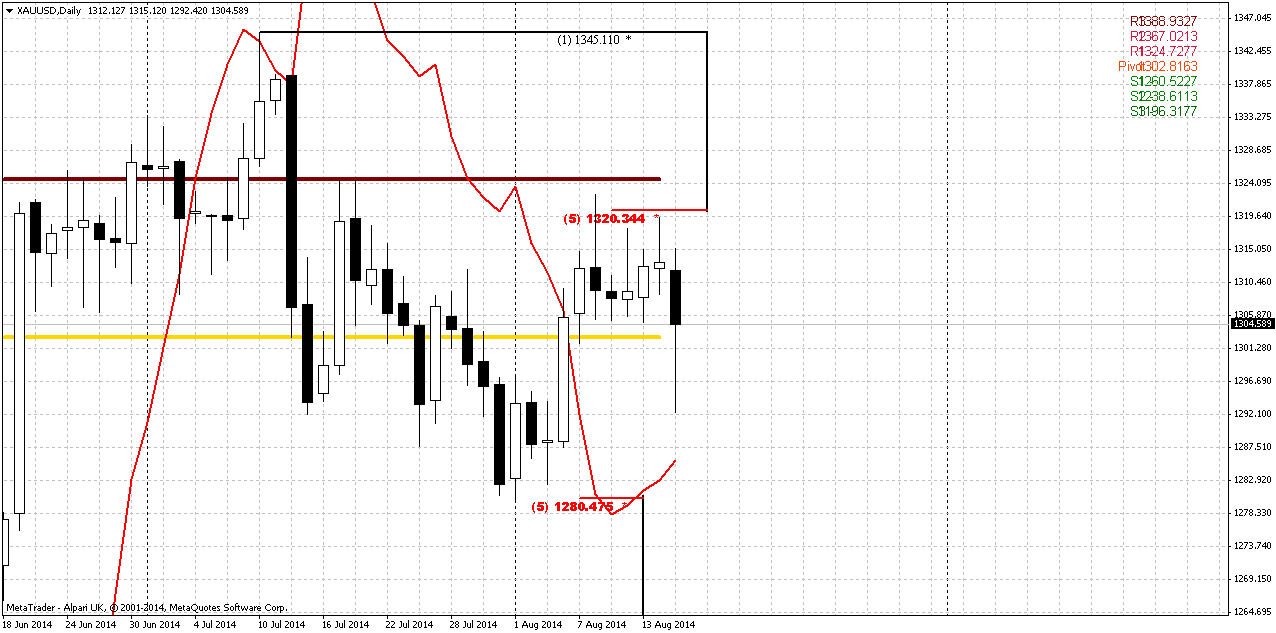

Daily

The major conclusion that could make here is that price has accomplished

what we’ve expected – deep retracement inside the body of weekly

grabbers. Situation on gold market still stands clear as on previous

week. As market most part of week has spent in tight range nothing has

changed significantly.

I do not want to say that it will be simple to trade it, but, at least

we have clarity in short-term perspective. We’ve estimated that’s a bit

early, or, even unsafe to enter short. Hence, we can either enter long

or do nothing. If we will enter long – we just need only recent swing up

on daily chart, because this is a swing of our weekly grabbers. If

market will erase this swing – it will erase grabbers also and our

trading context will disappear as well, right? Consequently, we need

just watch for most recent lows as invalidation point and try to take

long position as close to them as possible.

Previously we’ve mentioned some concerns on existed downward AB-CD

patterns that were not completed properly. But right now minor (4-hour)

AB-CD has been erased, since price has moved above C point. Daily AB-CD

still exists, and this will be our task – it would be nice if price will

take out top in red square on chart. In this case all our concerns will

be resolved. On daily chart trend is bullish as well.

So currently market has accomplished all requirements. Recall that in

the beginning of the week situation was so that market is ready move up

immediately. But when once, then twice gold has shown inability to move

higher – we’ve come to conclusion on possible deeper retracement that

has happened on Friday. Thus, right now we can try to take long position

if you would like to take part in weekly grabbers trading.

4-hour

Here, on 4-hour chart we will take a look at broader picture. First is

take a look that market still has touched our 5/8 Fib support as we’ve

said “Gold likes to show deep retracements”. By this action it gives

oportunity to take long position. Also market has hit 4-hour oversold.

But this moment is important by another reason either.

Take a look at this chart. Precise 5/8 retracement lets us think about

possible H&S pattern, right? Even more, current low becomes very

significant point, since if market will break it down – H&S will

fail. Double Bottom is also possible here, but action before “head” of

the pattern tells that H&S is still prefferable.

1-hour

In general it would better to take a look at 30-min or even 15-min chart

here, but in this case we will miss very important detail – bearish

grabber that suggests downward retraceent. Since plunge down was solid

and it still a bit confuses me – market probably will show deep

retracement and this could give us AB=CD down to Agreement with 1300 Fib

support. On lower charts you probably could find even some butterfly

Buy that will have destination point around the same 1300 area.

Conclusion:

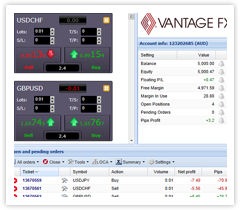

Trade with Winners

Trade smarter with this deluxe set of tools

Vantage FX SmartTrader Tools

The Trading Package for MT4

ALARM MANAGER:

Go beyond just receiving alerts. This unique and powerful trade notification tool will not only alert you of activities – it can automatically trade for you.

Set the alarms, apply your rules and triggers, and the alarm manager will do the rest!

6 types of alarms

Automatically trigger market or pending orders, close some or all trades!

Alerts via SMS, email, pop-up, sound, or even broadcast on Twitter!

TRADE TERMINAL:

This advanced trade execution and analysis tool allows for quick, precision trading. A one-click trade manager with a plethora of built-in functions.

Trade professionally, quickly and never miss that trade opportunity again!

Quick opening of market, pending and OCO orders

Close trades on an individual, selected, or all-trades basis

Create templates for frequently-used or complex order preferences

Quick modification of S/L, T/P and trailing stops

Trade & risk calculators and analysis functions

Alarms with triggered actions

MARKET MANAGER:

Ever wanted to edit the market watch panel in MT4? Well, now you can completely customise it with full control over symbol watch-lists and order activity all from one convenient window.

Name and save preferred symbols in convenient groups in order preference

View graphic market overviews for each symbol covering the last 5 days, 24 hours and 60 minutes

Trade directly from the market manager!

CORRELATION MATRIX:

An easy-to-use matrix grid for all your symbols. See at a glance correlation scores and the strength of these patterns. No need for separate spreadsheet tools!

Select correlation time period ranging from 1 hour to 1 week

Choose different correlation displays, range and sizing

Pick your symbols and products from the Forex, Commodities and Indices market

CORRELATION TRADER:

Want to see correlation patterns over time and need something more than just the quick scores? The Correlation Trader allows you to easily compare market charts and directly trade from the tool.

Select your markets and timescales to compare with key figures such as net profits for each symbol

Open and close orders, place S/L and T/P in both hedging/non-hedging mode directly from the charts

SENTIMENT TRADER:

See the general trading sentiment moods and directions of all your symbols quickly right in your MT4.

Shows current sentiment, historic sentiment plotted against price, and also any open positions in the selected symbol

Configurable views of market and historic sentiment

Open and close orders, place S/L and T/P in both hedging/non hedging mode directly within the tool

SESSION MAP:

The Session Map gives the trader a visual market overview through the world’s key markets and time-zones.

Displays world’s main markets with a time-line reflecting trader’s local time

Markers for future calendar events impact colour-coded

Price movements information for each completed or current market session

Account information including floating P/L and margin usage

CONNECT PANEL:

Get the news first with your own personalised news feed and economic calendar with the ability to include RSS feeds and alerts, and set filters. You can also trade Binary Options directly from within MT4 via the Connect Panel.

EXCEL RTD LINK:

MS Excel fans can now compare, analyse and create rules in real-time across multiple accounts using their favourite spreadsheets.

Put real-time account, ticket, and price data into Excel using only Excel’s built-in RTD function.

No macros, no programming, no XLL add-in

Send trading commands from VBA code in Excel (or from any COM supporting language)

Situation on gold market remains sophisticated. Despite some obviously bearish moments, such as bullish

USD sentiment, lack of physical demand, gold does not show real

downward acceleration and we could see that gold troubles downward

action. Definitely that there are some reasons for that and they

probably are not limited by just geopolitical tensions. Technically we

also see these signs, since we’ve got 3 weekly bullish grabbers in a row. Their minimum target achievement will not be able to vanish bearish setup totally, but it could become the starting point for something bigger. Thus, although we acknowledge existing of bearish situation on monthly, we simultaneously see some inner process that could trigger at least deep upside retracement in medium-term or potentially even shift long-term sentiment to bullish .

In this situation it is better to work on definite patterns, such as grabber that we’ve got on weekly chart.

In short term perspective situation is relatively clear. Market has

completed all our conditions for long entry and it is no sense to wait

more – either weekly bullish

patterns will start to work or they will fail. Thus, we could think

about long entry around 1300 area with stop below weekly grabbers’ lows.

Trade with Winners

Trade smarter with this deluxe set of tools

The Trading Package for MT4

ALARM MANAGER:

Go beyond just receiving alerts. This unique and powerful trade notification tool will not only alert you of activities – it can automatically trade for you.

Set the alarms, apply your rules and triggers, and the alarm manager will do the rest!

6 types of alarms

Automatically trigger market or pending orders, close some or all trades!

Alerts via SMS, email, pop-up, sound, or even broadcast on Twitter!

TRADE TERMINAL:

This advanced trade execution and analysis tool allows for quick, precision trading. A one-click trade manager with a plethora of built-in functions.

Trade professionally, quickly and never miss that trade opportunity again!

Quick opening of market, pending and OCO orders

Close trades on an individual, selected, or all-trades basis

Create templates for frequently-used or complex order preferences

Quick modification of S/L, T/P and trailing stops

Trade & risk calculators and analysis functions

Alarms with triggered actions

MARKET MANAGER:

Ever wanted to edit the market watch panel in MT4? Well, now you can completely customise it with full control over symbol watch-lists and order activity all from one convenient window.

Name and save preferred symbols in convenient groups in order preference

View graphic market overviews for each symbol covering the last 5 days, 24 hours and 60 minutes

Trade directly from the market manager!

CORRELATION MATRIX:

An easy-to-use matrix grid for all your symbols. See at a glance correlation scores and the strength of these patterns. No need for separate spreadsheet tools!

Select correlation time period ranging from 1 hour to 1 week

Choose different correlation displays, range and sizing

Pick your symbols and products from the Forex, Commodities and Indices market

CORRELATION TRADER:

Want to see correlation patterns over time and need something more than just the quick scores? The Correlation Trader allows you to easily compare market charts and directly trade from the tool.

Select your markets and timescales to compare with key figures such as net profits for each symbol

Open and close orders, place S/L and T/P in both hedging/non-hedging mode directly from the charts

SENTIMENT TRADER:

See the general trading sentiment moods and directions of all your symbols quickly right in your MT4.

Shows current sentiment, historic sentiment plotted against price, and also any open positions in the selected symbol

Configurable views of market and historic sentiment

Open and close orders, place S/L and T/P in both hedging/non hedging mode directly within the tool

SESSION MAP:

The Session Map gives the trader a visual market overview through the world’s key markets and time-zones.

Displays world’s main markets with a time-line reflecting trader’s local time

Markers for future calendar events impact colour-coded

Price movements information for each completed or current market session

Account information including floating P/L and margin usage

CONNECT PANEL:

Get the news first with your own personalised news feed and economic calendar with the ability to include RSS feeds and alerts, and set filters. You can also trade Binary Options directly from within MT4 via the Connect Panel.

EXCEL RTD LINK:

MS Excel fans can now compare, analyse and create rules in real-time across multiple accounts using their favourite spreadsheets.

Put real-time account, ticket, and price data into Excel using only Excel’s built-in RTD function.

No macros, no programming, no XLL add-in

Send trading commands from VBA code in Excel (or from any COM supporting language)

See Why VantageFx ?

_Trade with Winners:

Australian financial service providers, Vantage FX,

have received a multitude of awards over the years including those from IB Times,

Deal Makers, The World Finance Foreign Exchange Awards, Smart Investor and many more.

_Vantage FX have:

Award-winning Execution Speeds

Competitive spreads from 0.0 pips

24/5 Premium Customer Support

_Trade with Choice:

Take your pick. Choose from -->

32 Forex currency pairs

Major indices including SPI200, S&P500, DJ30

Commodities – gold, silver and crude oil

Binary Options – click here to read more about this exciting, new way to trade

_Trade with flexibility:

Choose your leverage amount ranging from 1:1 to 500:1

Choose your lot size - micro, mini or standard lots

Choose your account type – Standard or Pro, Individual or Joint

_Trade Your Way:

Choose the trading solution that matches your trading style:

The popular MetaTrader 4 (MT4)

MT4 for Mac – Exclusive to Vantage FX in Australia

MetaTrader 5

WebTrader

Mobile trading apps for iPhone, iPad and Android

Social trading via FX Copy

_Trade Securely and with Transparency:

No Dealing Desk Execution. No Requotes

100% Straight Through Processing

ASIC Regulated Standards

Funds Secure in Segregated Client Accounts at NAB

_Trade Wisely:

Daily market analysis from our key expert writer and currency strategist, Greg McKenna

Daily Forex Currency Highlights reports

Learn, follow and copy leading successful traders on FX Copy

Free Autochartist tools for live Vantage FX account holders

Free webinars and access to webinar archives

Other educational resources including infographics, glossary and guides

Samer Al Reifae

support5002@vantagefx.com

https://www.facebook.com/LORDOFTRUTH

https://www.facebook.com/FollowTheRaw

https://www.facebook.com/groups/vantagefx/

http://lordoftruth.blogspot.com/

_Trade with Winners:

Australian financial service providers, Vantage FX,

have received a multitude of awards over the years including those from IB Times,

Deal Makers, The World Finance Foreign Exchange Awards, Smart Investor and many more.

_Vantage FX have:

Award-winning Execution Speeds

Competitive spreads from 0.0 pips

24/5 Premium Customer Support

_Trade with Choice:

Take your pick. Choose from -->

32 Forex currency pairs

Major indices including SPI200, S&P500, DJ30

Commodities – gold, silver and crude oil

Binary Options – click here to read more about this exciting, new way to trade

_Trade with flexibility:

Choose your leverage amount ranging from 1:1 to 500:1

Choose your lot size - micro, mini or standard lots

Choose your account type – Standard or Pro, Individual or Joint

_Trade Your Way:

Choose the trading solution that matches your trading style:

The popular MetaTrader 4 (MT4)

MT4 for Mac – Exclusive to Vantage FX in Australia

MetaTrader 5

WebTrader

Mobile trading apps for iPhone, iPad and Android

Social trading via FX Copy

_Trade Securely and with Transparency:

No Dealing Desk Execution. No Requotes

100% Straight Through Processing

ASIC Regulated Standards

Funds Secure in Segregated Client Accounts at NAB

_Trade Wisely:

Daily market analysis from our key expert writer and currency strategist, Greg McKenna

Daily Forex Currency Highlights reports

Learn, follow and copy leading successful traders on FX Copy

Free Autochartist tools for live Vantage FX account holders

Free webinars and access to webinar archives

Other educational resources including infographics, glossary and guides

Samer Al Reifae

support5002@vantagefx.com

https://www.facebook.com/LORDOFTRUTH

https://www.facebook.com/FollowTheRaw

https://www.facebook.com/groups/vantagefx/

http://lordoftruth.blogspot.com/

The Gold Price & Trend Predictions blog made for gold traders to find good news and to provide the traders with daily price predictions and to learn how to trade the Forex Market for free.Just pure learning! It will be of great fun.You can judge by yourself the quality of information that I will be giving you in my blog.

Welcome to my blog where you can learn how to trade the Forex Market for free.The material is all created by myself and not copied from anywhere. There is a lot yet to come since there is a lot that you need to learn, and there is a lot that I need to share with you! So please just be patient – it will be worth it.You can judge by yourself the quality of information that I will be giving you . So just go now and start learning!

Below is a quick guide of how this website is structured, so you can find what you are looking for fast. Remember that I update the pages every day so either check back often.

In this section you will find quite a long article of what Forex is all about. If you are a beginner, this is a must read. It explains in detail what is required to start trading, what you should do and not, typical traps to avoid as a beginner and a lot of valuable information which you as a beginner must digest and learn prior opening any Forex account with real money.

In this section you will find your road map on how to become a real successful trader couple of months as from today.

In this section you will know the 3 major areas – Technical Analysis, Fundamental Analysis and Trading Physcology.

In this section you will find a gold mine of information about the technicalities of Forex. We will start from the very basics covering all the Forex jargon words which you will be hearing every day and we will be taking you up to the level required to finally learn to trade like a pro – technical analysis, also found in this section.

In this section you will see the tips that will help you stay away from crap forex products, which unfortunately the Forex market is invaded with.

This section has a very detailed article on how to avoid being scammed in this ruthless world of Forex. I will explain in detail six tips that you need to look for prior purchasing any products. Even though most of the time you may claim your money back,the time wasted is never returned. You should have used that time to learn how to trade! Read it!

YOU SHOULD NOT TAKE ANY MATERIAL posted on this BLOG AS RECOMMENDATIONS

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

Do your own due diligence.

No one knows tomorrow's price or circumstance.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.

King Regards