18 April 2016, 11:09

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 10150.0 |

| Take Profit | 10455.2 |

| Stop Loss | 10010.1 |

| Key Levels | 9494.2, 9754.2, 9904.5, 10124.3, 10485.2, 10872.2 |

| Alternative Scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 9895.0 |

| Take Profit | 9765.2 |

| Stop Loss | 9925.9 |

| Key Levels | 9494.2, 9754.2, 9904.5, 10124.3, 10485.2, 10872.2 |

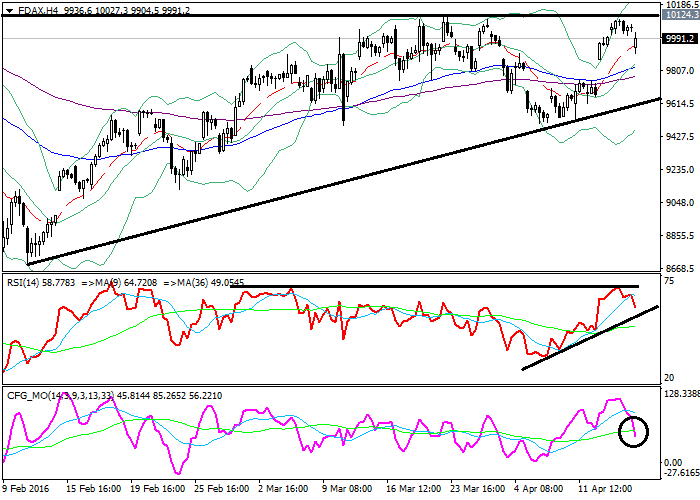

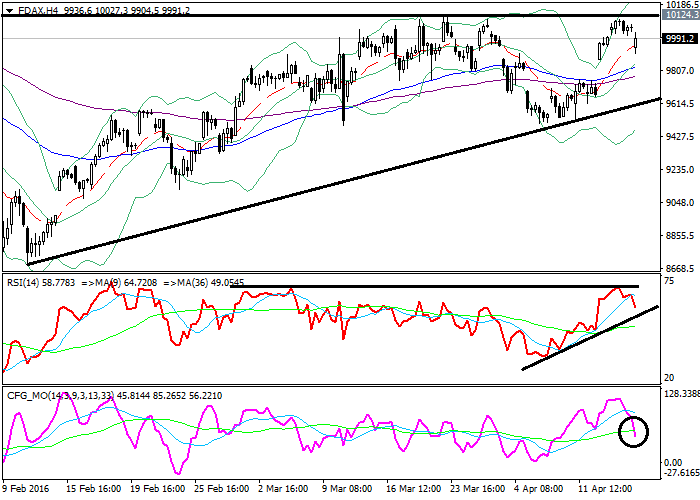

FDAX, H4

On the 4-hour chart, the index is approaching the apex of a correctional

triangle. The instrument is trading in the upper Bollinger band while bands are

directed up. The price remains above its moving averages that turned up. The RSI

has failed its strong resistance and falling. The Composite has broken down its

longer MA having developed a more significant downward movement.

Key Levels

Support levels: 9904.5 (local lows), 9754.2 (EMA130), 9494.2 (beginning of

April lows).

Resistance levels: 10124.3 (upper triangle side), 10485.2 (beginning of

January gap), 10872.2 (December 2015 highs).

Long positions can be opened from the level of 10150.0 with the target at

10455.2 and stop-loss at 10010.1. Validity – 2-3 days.

Short positions can be opened from the level of 9895.0 with the target at

9765.2 and stop-loss at 9925.9. Validity – 2-3 days.

The Bonus is not granted automatically.

The client must claim / request the Bonus by

contacting finance department

at finance@hiwafx.com

or via livechat.

Terms & Conditions

The client must claim / request the Bonus by

contacting finance department

at finance@hiwafx.com

or via livechat.

Terms & Conditions

with

M Samer Al Reifae

Official HiWayFX Representative in Romania

samer@hiwayfx.com

+40 734 277 757

Official HiWayFX Representative in Romania

samer@hiwayfx.com

+40 734 277 757

- YOU ARE NEVER LEFT ALONE -

YOU SHOULD NOT TAKE ANY MATERIAL posted on this BLOG AS RECOMMENDATIONS

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

Do your own due diligence.

No one knows tomorrow's price or circumstance.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.