Follow The XM Bull

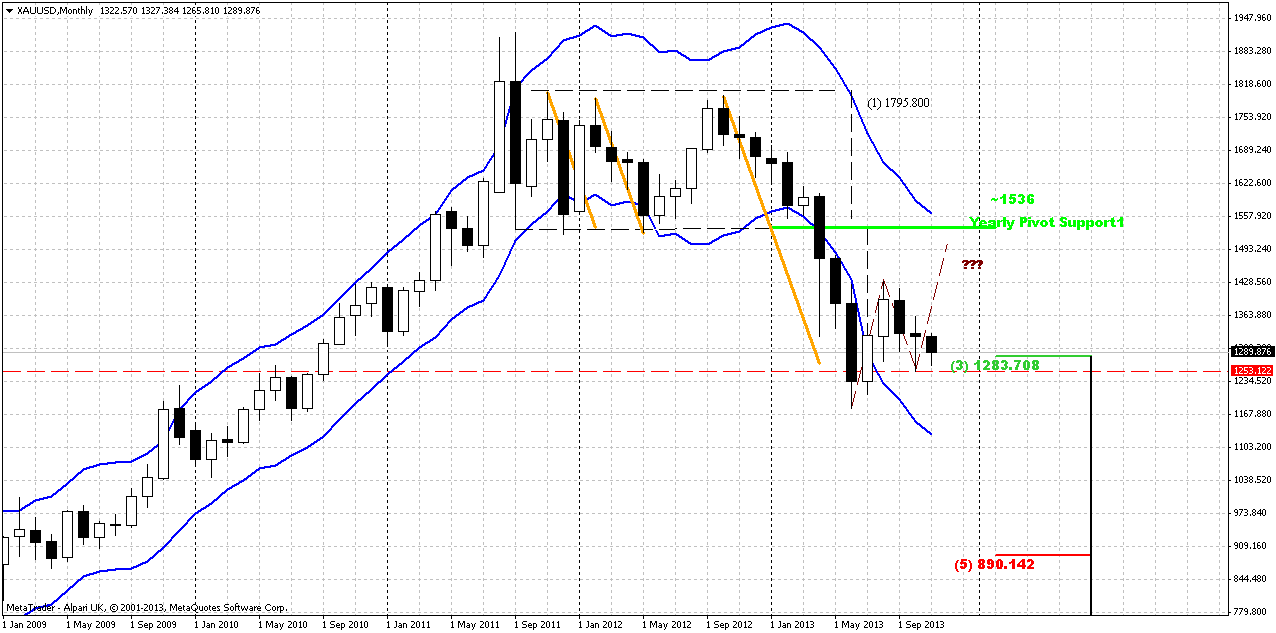

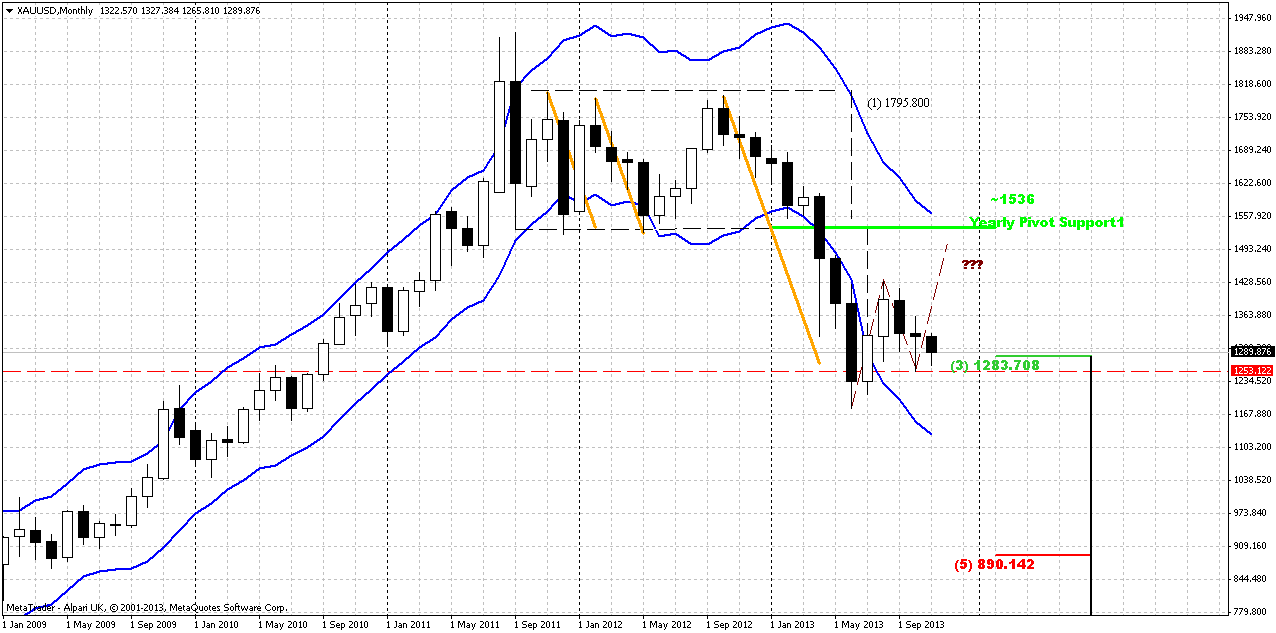

Monthly

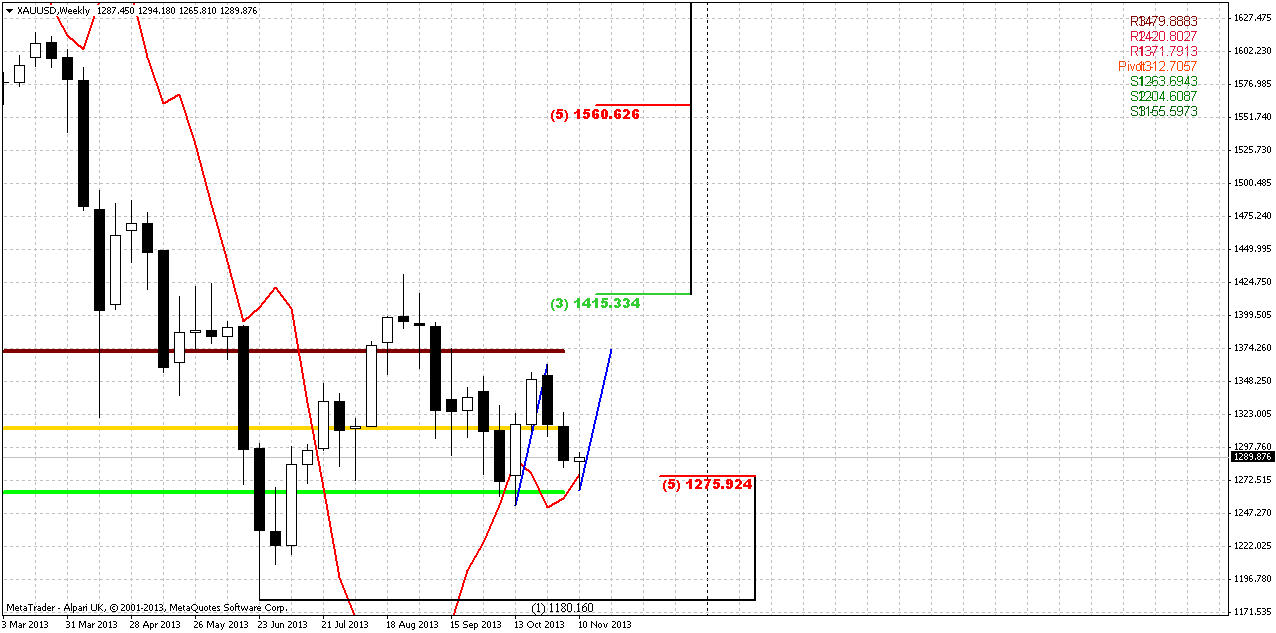

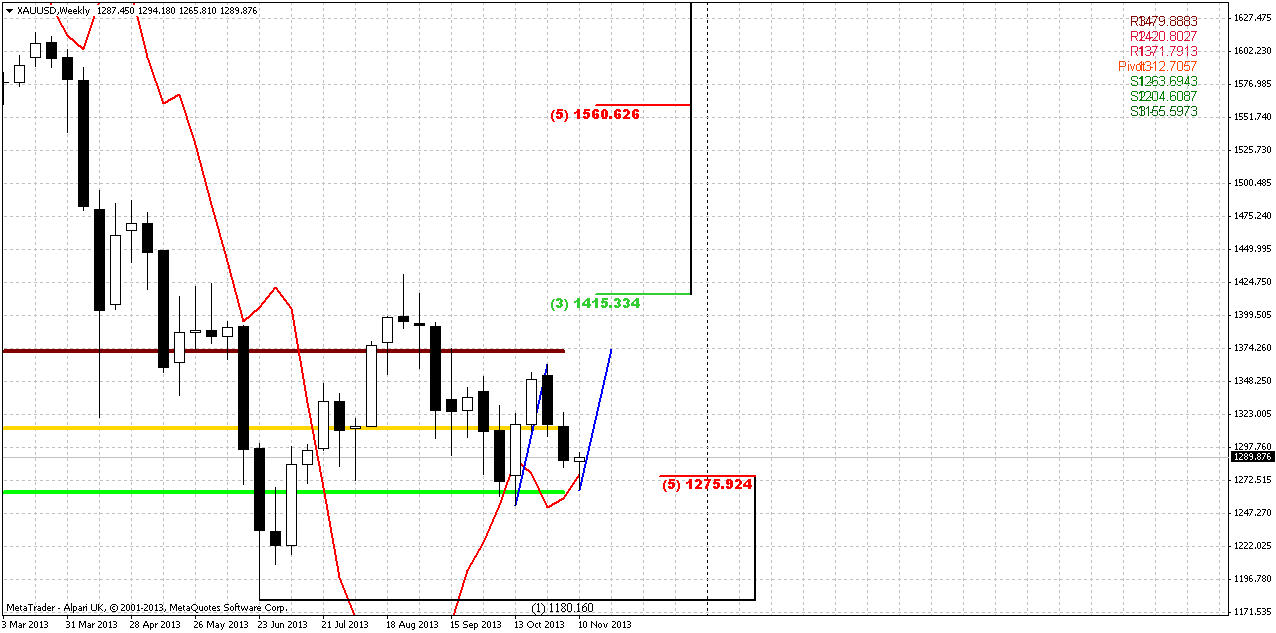

Weekly

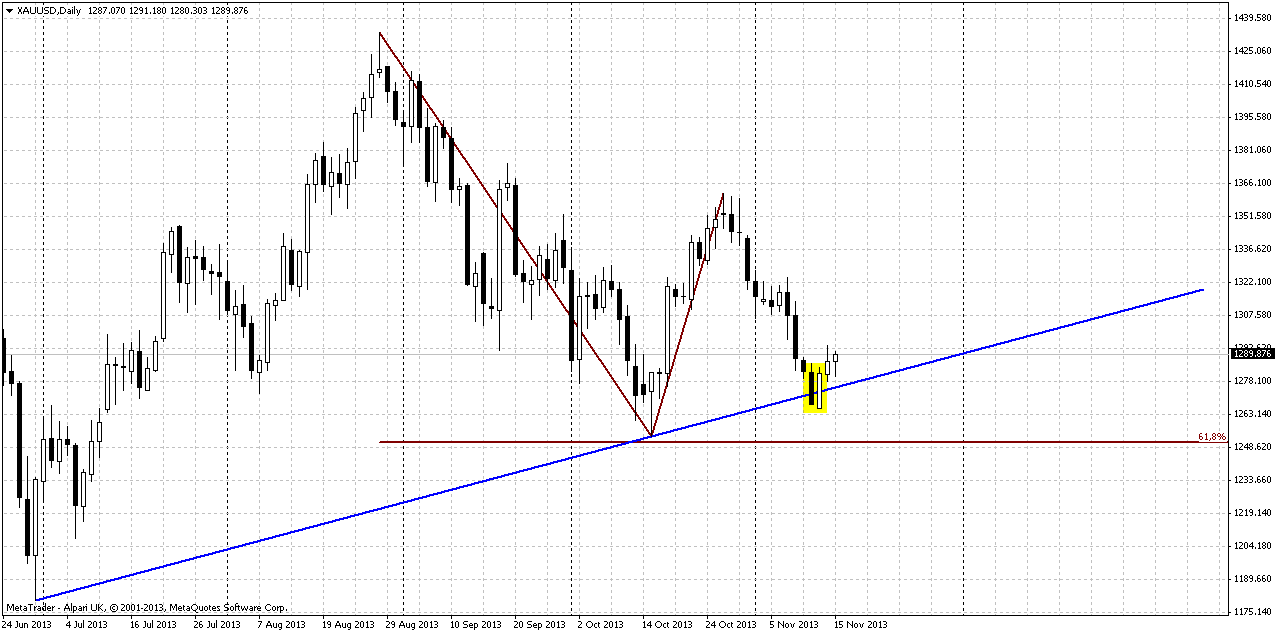

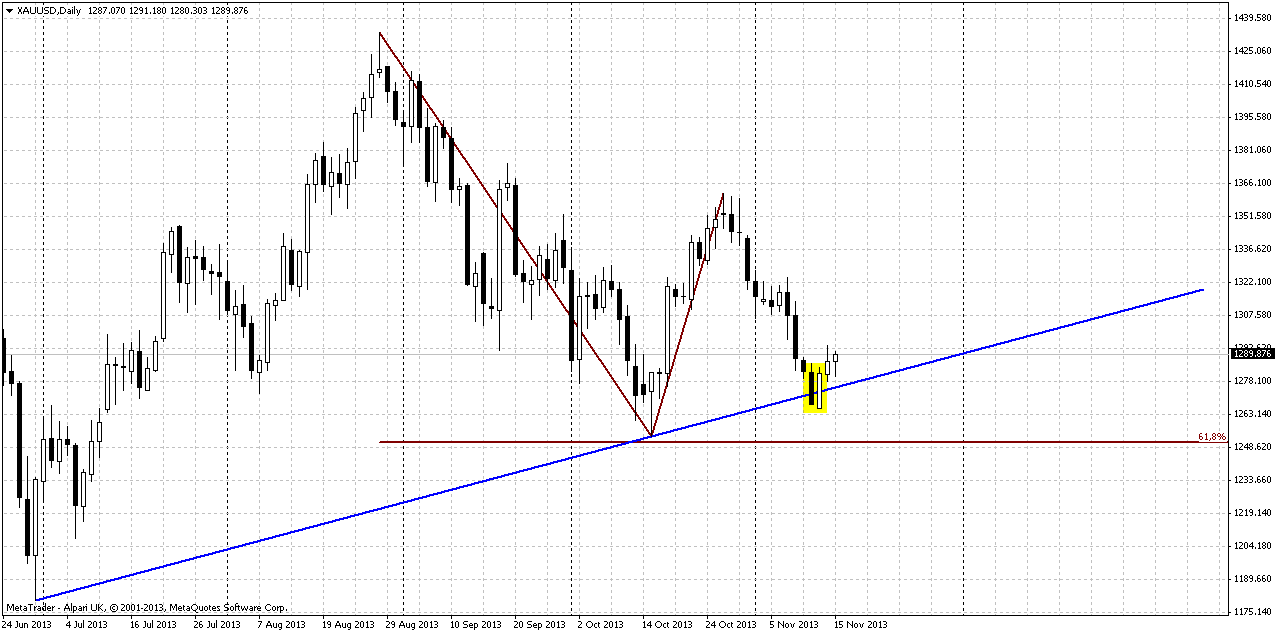

Daily

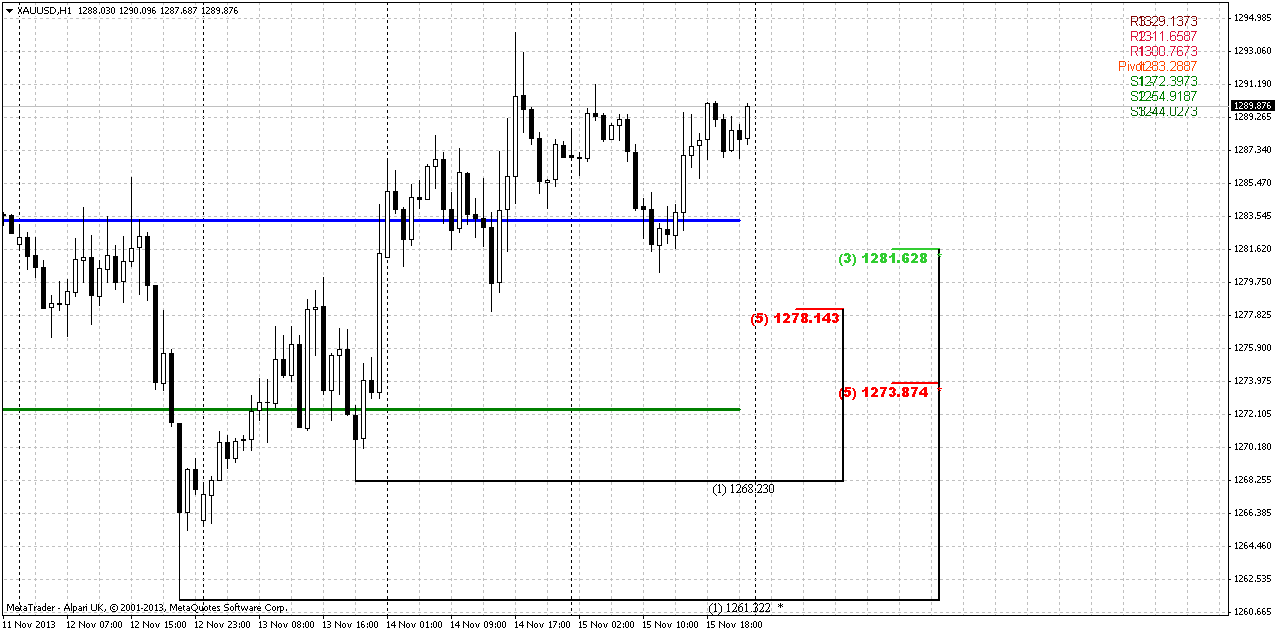

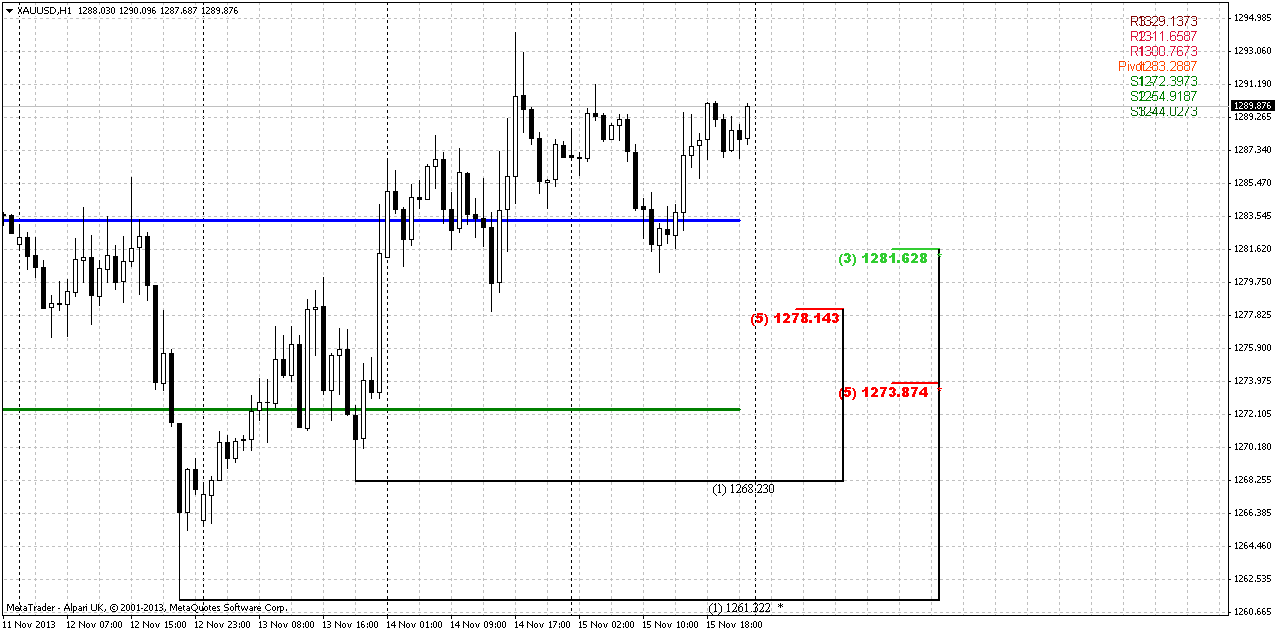

1-hour

Monthly

Whether we will get upward retracement and possible BC leg of larger

AB=CD down move or not – that was our question for previous months and

not much has changed here by far. As lows of October holds – chances are

exist that market still could show upward action. While october has

shifted to doji right in the end of the month and November has started

from solid decline – now this fall calms down a bit and who knows, may

be some recovery will happen. Fundamental situation and CFTC data stand

not in favor of possible appreciation, but recent Yellen’s comments

could support market in very short-term perspective. Seasonal trend is

still bullish, but it is not always lead to growth. Sometimes, it could

just hold depreciation and now we see something of this kind, since

market stands in some range since August.

Our previous analysis (recall volatility breakout - VOB) suggests upward

retracement. As market has significantly hit oversold we’ve suggested

that retracement up should be solid, may be not right to overbought, but

still significant. Take a look at previous bounces out from oversold –

everytime retracement was significant. Thus, we’ve made an assumption of

possible deeper upward retracement that could take a shape of AB=CD,

and invalidation for this setup is previous lows around 1170s. If market

will pass through it, then, obviously we will not see any AB=CD up.

Now market is approaching to previous lows and the question is whether they will hold or not.

Weekly

This time frame puts the foundation for short-term trading. As market

has reached the minimum target of bearish engulfing, that was suddenly

formed, now price has opportunity to change direction for short-term and

simultaneously do not break overall bearish development. So, guys, here

we have bullish stop grabber pattern right at MPS1 and Fib support. Its

minimum target stands around 1350 and it could be reached as AB-CD.

Looking a bit further, theoretically it could even lead to butterfly

sell appearing, but this is a bit early object for discussion.

Conversely, invalidation point of grabber stands at its low – 1265 and

if market will destroy it, we will return right back to bearish setup

and butterfly “buy” on weekly that we’ve discussed earlier. Anyway,

short-term development that could follow on coming week and completion

of small AB-CD will not cancel bearish setup yet. From that standpoint

we could say that we will be focused mostly on tactical trading rather

on strategic on this week.

Daily

Trend is bearish here, market is not at oversold. In fact now situation

mostly depends on what will happen with this engulfing pattern, because

this pattern simultaneously is a swing of stop grabber on weekly chart.

Other words, whether it will lead market to real bounce up or it will

fail. The major worry with it is existing of AB=CD minor 0.618 target

slightly under this pattern. Still, as we have pattern, let’s try to use

it and focus particularly on it, and then we’ll see what will happen.

1-hour

On 4-hour chart I see nothing special, except may be existance of

reversal swing up, that is greater than previous swing down. Hourly

chart shows the swing of stop grabber itself. So, since we intend to try

to trade it, there are two significant support areas. First one is

K-support around WPP and second one is combination of WPS1 and 5/8 Fib

support around 1272-1274. Currently is it unclear what particular level

price could reach but both of them are suitable and will not cancel

possible upward action. Although invalidation point of grabber is its

low, we probably also should keep an eye on 1268 low. If it will be

taken out, then chances that grabber will be cancelled increase

significantly.

Gold has a habit to show deep retracements and current top shape blurly

reminds H&S but it looks too skew and hardly worthy of relation on

it.

and start earning commissions from all

the trading activity of the clients you referred to XM.

The Advantages of Promoting XM:

The Highest Conversion in the Industry

Ability to transfer funds between IB account from/to client account

No limits on how much you can earn

No limits on how much you get paid every month

Fastest and most reliable IB payouts

Transparent reporting and detailed statistics

Account Managers in more than 18 languages

Leverage up to 1:888 for your Clients

Low Minimum Deposit for your Clients

Multiple Deposit Options for your Clients

Monthly Timely Payments

Tailor-Made Solutions

No Fees to Start

Multiple Platforms to Promote

Flexible Commission Rates

Unlimited Banners and Artwork

Nonstop Promotions for your Clients

The Partner Promotion for 2013 Offers

| Clients | Commission on Currencies | Commission on Gold | Second Tier (Sub Ib's) |

|---|---|---|---|

| 3-10 | $7 | $25 | 10% |

| 11-30 | $8 | $25 | 10% |

| 31+ | $10 | $25 | 10% |

Get paid to trade Gold in 3 easy steps.

1. Open your account HERE

2. Send me your MT4 trading account number and email address

3. Send me your Paypal or Moneybookers account number

If you do not have a Paypal or Moneybookers account,

please click on one of the links below to open your free account today.

Moneybookers

Paypal

You will be paid $10 per standard lot of Gold traded and

all payments will be made by the 25th of each month.

In order for your payment to be processed each month, please send me an email requesting payment and stating the amount of lots you have traded and your MT4 account number between the 20th and 24th of the month.

thelordoftruth@gmail.com

1. Open your account HERE

2. Send me your MT4 trading account number and email address

3. Send me your Paypal or Moneybookers account number

If you do not have a Paypal or Moneybookers account,

please click on one of the links below to open your free account today.

Moneybookers

Paypal

You will be paid $10 per standard lot of Gold traded and

all payments will be made by the 25th of each month.

In order for your payment to be processed each month, please send me an email requesting payment and stating the amount of lots you have traded and your MT4 account number between the 20th and 24th of the month.

thelordoftruth@gmail.com

The Gold Price & Trend Predictions blog made for gold traders to find good news and to provide the traders with daily price predictions and to learn how to trade the Forex Market for free.Just pure learning! It will be of great fun.You can judge by yourself the quality of information that I will be giving you in my blog.

Welcome to my blog where you can learn how to trade the Forex Market for free.The material is all created by myself and not copied from anywhere. There is a lot yet to come since there is a lot that you need to learn, and there is a lot that I need to share with you! So please just be patient – it will be worth it.You can judge by yourself the quality of information that I will be giving you . So just go now and start learning!

Below is a quick guide of how this website is structured, so you can find what you are looking for fast. Remember that I update the pages every day so either check back often.

In this section you will find quite a long article of what Forex is all about. If you are a beginner, this is a must read. It explains in detail what is required to start trading, what you should do and not, typical traps to avoid as a beginner and a lot of valuable information which you as a beginner must digest and learn prior opening any Forex account with real money.

In this section you will find your road map on how to become a real successful trader couple of months as from today.

In this section you will know the 3 major areas – Technical Analysis, Fundamental Analysis and Trading Physcology.

In this section you will find a gold mine of information about the technicalities of Forex. We will start from the very basics covering all the Forex jargon words which you will be hearing every day and we will be taking you up to the level required to finally learn to trade like a pro – technical analysis, also found in this section.

In this section you will see the tips that will help you stay away from crap forex products, which unfortunately the Forex market is invaded with.

This section has a very detailed article on how to avoid being scammed in this ruthless world of Forex. I will explain in detail six tips that you need to look for prior purchasing any products. Even though most of the time you may claim your money back,the time wasted is never returned. You should have used that time to learn how to trade! Read it!

YOU SHOULD NOT TAKE ANY MATERIAL posted on this BLOG AS RECOMMENDATIONS

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

Do your own due diligence.

No one knows tomorrow's price or circumstance.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.

King Regards