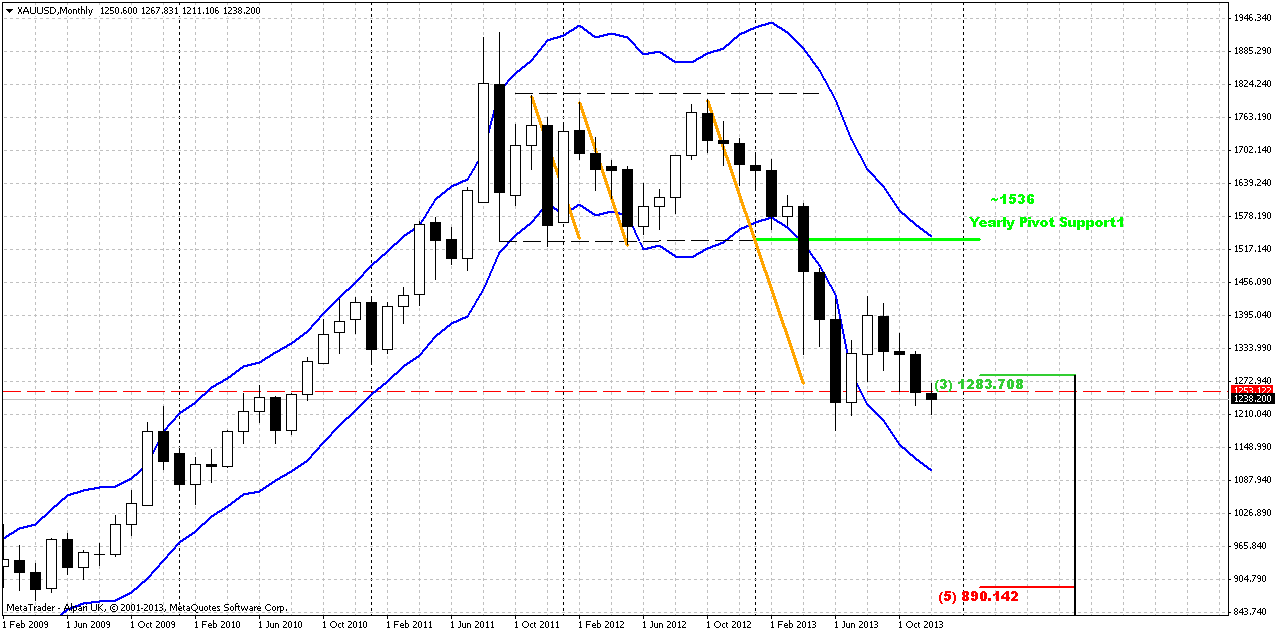

Monthly

Market slowly but stably moves lower here. There was no outstanding

action on previous week, thus, we hardly could see any changes on

monthly chart. Chances on appearing of possible upward AB=CD are melting

week by week. Market has moved and closed below October lows.

Fundamental situation and CFTC data stand not in favor of possible

appreciation. As market was significantly oversold we’ve suggested

retracement up. Thus, we’ve made an assumption of possible deeper upward

retracement that could take a shape of AB=CD, and invalidation for this

setup is previous lows around 1170s. If market will pass through it,

then, obviously we will not see any AB=CD up. And now, as market has

broken through 1250, next target is precisely previous lows around 1180.

In fact this will be the last chance for possible upward bounce, if,

say, market will shows something like double bottom. Price is not at

oversold right now and not at major support, so really bearish market

should reach previous lows level. Gold will be jiggered if it wouldn’t

test previous lows, since this is very typical for gold market.

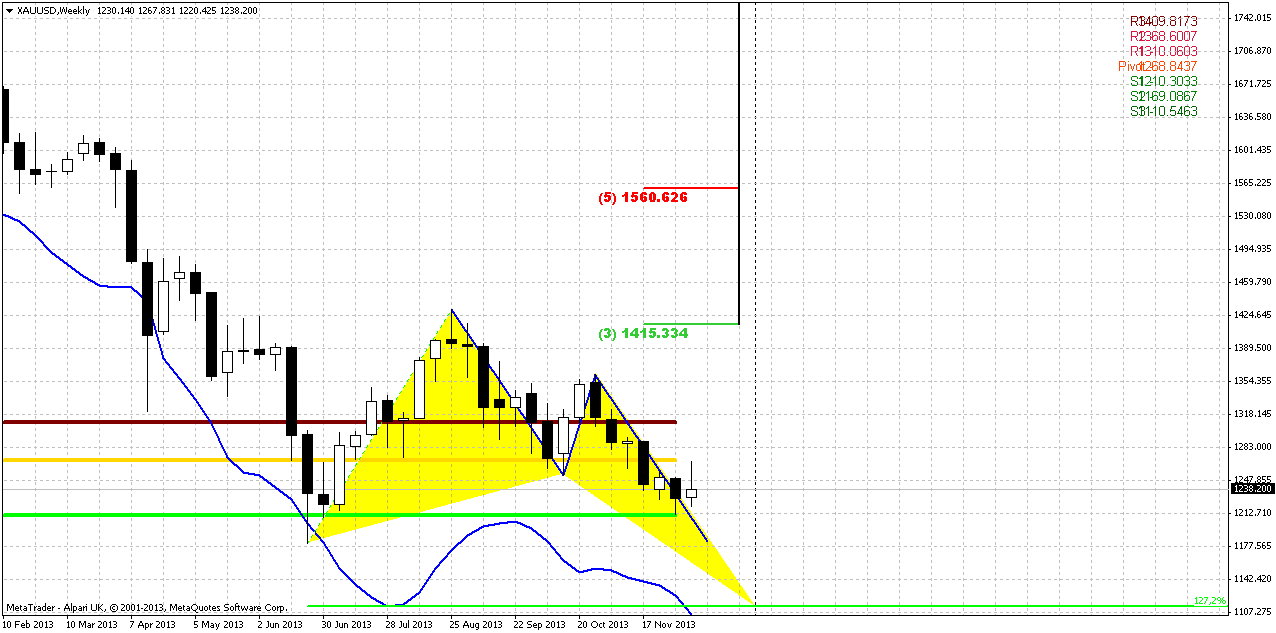

Weekly

Overall context here is bearish as well. As we’ve said previously, price

has broken through major 5/8 Fib support here. Previous week has made a

challenge to show meaningful retracement up, but all that price could

do is just to test monthly pivot point and bounce down. This action

confirms bearish sentiment. Also take a look that passed week almost has

become an inside one. Recent three week have really tight range, but it

is possible that some acceleration could follow on FOMC meeting.

Concerning targets – they are the same. First is previous lows and target of AB-CD down. More extended target, if price will not only clear out lows but hold below it – possible butterfly “buy” around 1100 area.

Concerning targets – they are the same. First is previous lows and target of AB-CD down. More extended target, if price will not only clear out lows but hold below it – possible butterfly “buy” around 1100 area.

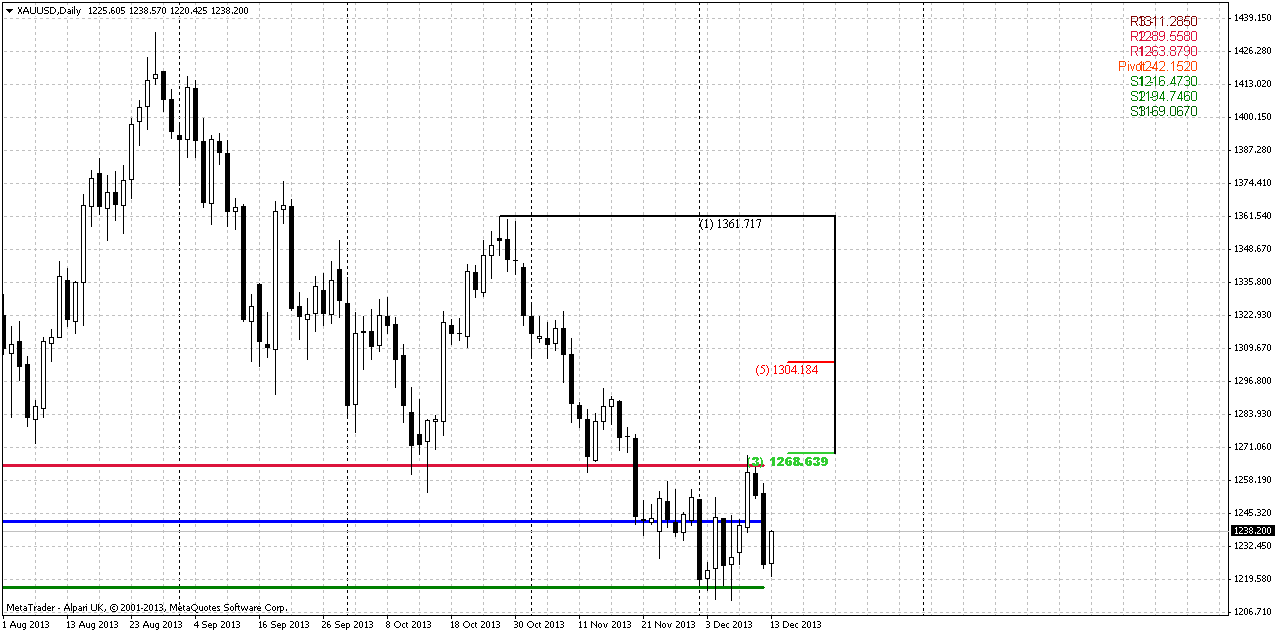

Daily

On daily time frame again - situation mostly could be treated as

“indecision”. Tactically, market has accomplished our short-term setup

and shown upward retracement to 1270 area, but this move just can’t

change anything strategically and can’t impact on overall balance on

gold market. In fact, price is coiling inside of tight range that on

coming week coincides with an area between WPR1 and WPS1. This is

logical since nobody wants to take additional risk right before Fed

meeting. CFTC data and trading volume of Chicago Exchange confirm this.

Very probable that market will continue to stay in the range till FOMC

meeting, but then breakout is possible and very probable that this

breakout will be downside, at least to accomplish AB-CD target and clear

out stops below 1180. The reason for that is that price stands between

0.618 and 1.0 extension and at least should show fake breakout or spike

down to complete AB-CD target of Wednesday volatility. As we’ve

discussed previously, market quite rare leaves untouched targets and

changes direction between Fib extensions. Conversely, at maximum –

market will continue move lower and this could be real breakout through

1180 area.

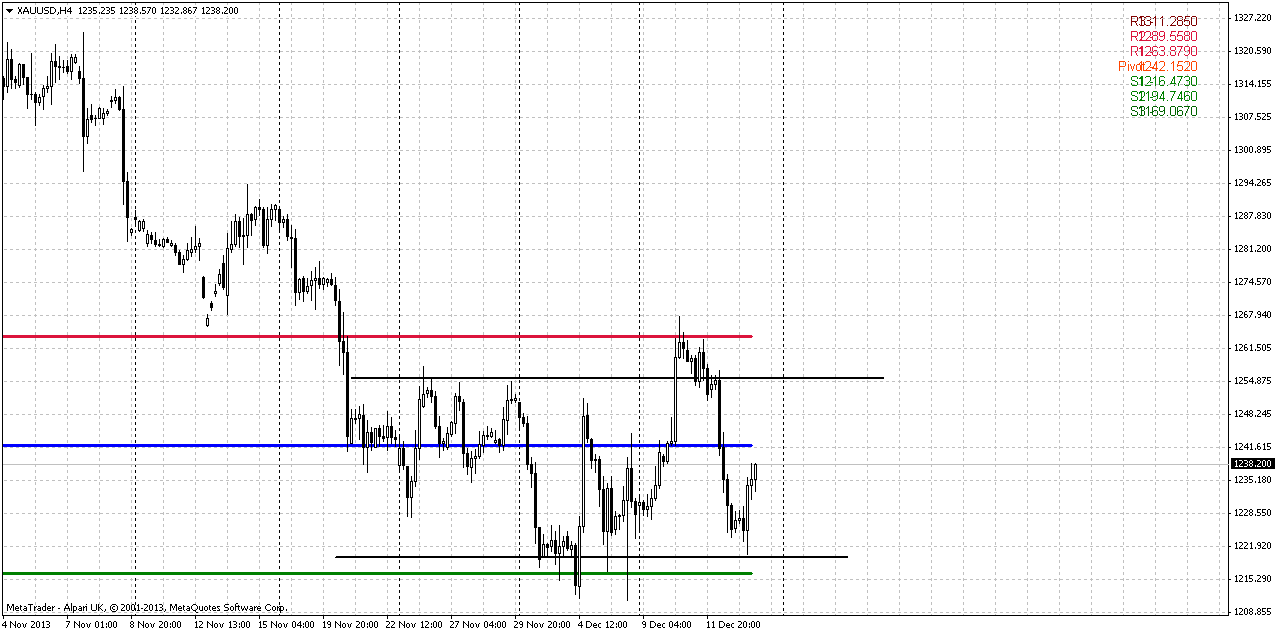

4-hour

Here we better can see how really choppy and sloppy price action is.

Movements are really nervous. As market has shown any significant action

in one or other direction – suddenly it shows opposite one and cancels

previous action. This is very typical for indecision situation. It is

difficult to find any patterns in this mess. As market has shown

failure upward breakout – it has moved right to the opposite border of

the consolidation. Now it is very probable that market will test WPP and

then will estimate short-term direction - either to WPR1 or WPS1. Major

direction we will get probably, only after FOMC meeting...Personally

for me guys, gold market looks not very attractive for trading right

now.

and start earning commissions from all

the trading activity of the clients you referred to XM.

The Advantages of Promoting XM:

The Highest Conversion in the Industry

Ability to transfer funds between IB account from/to client account

No limits on how much you can earn

No limits on how much you get paid every month

Fastest and most reliable IB payouts

Transparent reporting and detailed statistics

Account Managers in more than 18 languages

Leverage up to 1:888 for your Clients

Low Minimum Deposit for your Clients

Multiple Deposit Options for your Clients

Monthly Timely Payments

Tailor-Made Solutions

No Fees to Start

Multiple Platforms to Promote

Flexible Commission Rates

Unlimited Banners and Artwork

Nonstop Promotions for your Clients

The Partner Promotion for 2013 Offers

| Clients | Commission on Currencies | Commission on Gold | Second Tier (Sub Ib's) |

|---|---|---|---|

| 3-10 | $7 | $25 | 10% |

| 11-30 | $8 | $25 | 10% |

| 31+ | $10 | $25 | 10% |

Get paid to trade Gold in 3 easy steps.

1. Open your account HERE

2. Send me your MT4 trading account number and email address

3. Send me your Paypal or Moneybookers account number

If you do not have a Paypal or Moneybookers account,

please click on one of the links below to open your free account today.

Moneybookers

Paypal

You will be paid $10 per standard lot of Gold traded and

all payments will be made by the 25th of each month.

In order for your payment to be processed each month, please send me an email requesting payment and stating the amount of lots you have traded and your MT4 account number between the 20th and 24th of the month.

thelordoftruth@gmail.com

1. Open your account HERE

2. Send me your MT4 trading account number and email address

3. Send me your Paypal or Moneybookers account number

If you do not have a Paypal or Moneybookers account,

please click on one of the links below to open your free account today.

Moneybookers

Paypal

You will be paid $10 per standard lot of Gold traded and

all payments will be made by the 25th of each month.

In order for your payment to be processed each month, please send me an email requesting payment and stating the amount of lots you have traded and your MT4 account number between the 20th and 24th of the month.

thelordoftruth@gmail.com

The Gold Price & Trend Predictions blog made for gold traders to find good news and to provide the traders with daily price predictions and to learn how to trade the Forex Market for free.Just pure learning! It will be of great fun.You can judge by yourself the quality of information that I will be giving you in my blog.

Welcome to my blog where you can learn how to trade the Forex Market for free.The material is all created by myself and not copied from anywhere. There is a lot yet to come since there is a lot that you need to learn, and there is a lot that I need to share with you! So please just be patient – it will be worth it.You can judge by yourself the quality of information that I will be giving you . So just go now and start learning!

Below is a quick guide of how this website is structured, so you can find what you are looking for fast. Remember that I update the pages every day so either check back often.

In this section you will find quite a long article of what Forex is all about. If you are a beginner, this is a must read. It explains in detail what is required to start trading, what you should do and not, typical traps to avoid as a beginner and a lot of valuable information which you as a beginner must digest and learn prior opening any Forex account with real money.

In this section you will find your road map on how to become a real successful trader couple of months as from today.

In this section you will know the 3 major areas – Technical Analysis, Fundamental Analysis and Trading Physcology.

In this section you will find a gold mine of information about the technicalities of Forex. We will start from the very basics covering all the Forex jargon words which you will be hearing every day and we will be taking you up to the level required to finally learn to trade like a pro – technical analysis, also found in this section.

In this section you will see the tips that will help you stay away from crap forex products, which unfortunately the Forex market is invaded with.

This section has a very detailed article on how to avoid being scammed in this ruthless world of Forex. I will explain in detail six tips that you need to look for prior purchasing any products. Even though most of the time you may claim your money back,the time wasted is never returned. You should have used that time to learn how to trade! Read it!

YOU SHOULD NOT TAKE ANY MATERIAL posted on this BLOG AS RECOMMENDATIONS

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

TO BUY OR SELL GOLD OR ANY OTHER INVESTMENT VEHICLE LISTED.

Do your own due diligence.

No one knows tomorrow's price or circumstance.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.

I intend to portray my thoughts and ideas on the subject which may s be used as a tool for the reader.

I do not accept responsibility for being incorrect in my speculations on market trend.

King Regards